Hola technopolists,

‘Sexy’ in the tech world tends to be synonymous with ‘avant garde’. You might hear it in reference to augmented reality, simulated neural networks, or blockchain-based carbon credits.

But it’s Valentine’s Day, and that’s not the type of ‘sexy’ I’m talking about. PornHub, the world’s largest purveyor of online erotica, quietly released its Global Year in Review. For those who can stomach the subject matter, their annual reports are a masterclass in data-driven communication. They’re also a kind of alternative cultural thermometer.

Within LatAm, Mexico was the region’s most active country. And while the region generally has the shortest visit lengths of anyone in the world, none was shorter than Mexico (8 minutes, 45 seconds to be exact).

The most popular category in Brazil? Transgender. The country boasts the world’s friendliest trans-friendly legislation, with gender affirmation surgery guaranteed on the public system. It’s also home to trailblazing transgender supermodel Valentina Sampaio and two trans congresswomen. But there’s a darker side to that coin, too: Brazil has ranked worst in the world for rates of violence against trans and queer people for 13 years in a row, with 152 transfemicides in 2021 alone.

What’s Hot

🏦 PicPay enters payroll lending. PicPay, Brazil’s second-largest challenger bank, acquired payroll lending platform BX Blue for an undisclosed amount. Last year, PicPay expanded from paytech into full-fat neobank when it bought a banking license; through this acquisition, it adds payroll lending and BX Blue’s +1mn customers to a suite of wallets, P2P lending, and insurance products. As I wrote last week, payroll lending is a massive and fast-growing segment: in 2021, it was estimated as a +$112bn market growing 13% annually, and it’s one of the fastest-growing credit offerings for fintechs. Private credit in LatAm has attracted so much attention for filling gaps left by traditional banks that former Credit Suisse and Bladex bankers are launching a $600mn fund for it. (Neofeed)

🚗 Rappi pushes into logistics. The Colombia-based e-commerce platform announced RappiCargo, a B2B last-mile delivery service, that will launch in Chile. To start, the service will only deliver small parcels under 10 kilos. The launch is a stepping stone into a full-blown logistics business — the next logical (non-fintech) step to compete with the likes of Mercado Libre in its quest for superapp-dom. While the company is touting the Chilean launch as its inaugural B2B logistics play, that may not be the case: the company has a dormant, distinctively branded website for “Cargo by Rappi” in Uruguay offering B2B delivery. One last clue: RappiCargo advertised a job opening for Head of Partnerships in Mexico that’s since been taken down. (Tekios)

🇧🇷 Brazil’s oldest bank allows tax payments in crypto. Banco do Brasil partnered with crypto platform Bitfy to enable banking customers to pay off their tax bills using bitcoin and other popular cryptocurrencies. Customers will need to have a wallet with Bitfy, who will handle settlement in reais for BB. The announcement is the second major crypto initiative launched by a traditional financial institution, after Bradesco recently announced its tokenised credit notes. (Portal do Bitcoin)

What’s Not

👋🏽 Jokr exits Peru and Mexico. Almost immediately after last week’s $50mn fundraise announcement, the Brazil-based grocery delivery company announced the sale of its Peruvian business to InRetail and the closure of its operations in Mexico. Jokr’s retreat from Spanish-speaking LatAm is now complete, first leaving Colombia and Chile before these latest announcements. Now, the path to profitability (and survival) in the region lies exclusively in Brazil, where it’ll have to compete against titans iFood and Rappi. (Forbes)

😟 Rappi and iFood take legal knocks. The Colombian industry body for restauranteurs flagged Rappi to the tax office, claiming the food unicorn dodges consumption taxes to the tune of ~2% of total order value. While Rappi is fighting that complaint, it’s celebrating a win in Brazil: the industry competition watchdog, CADE, is forcing iFood to significantly curtail the scope of its restaurant exclusivity contracts after a complaint spearheaded by Rappi last year. The exclusivity deals, which propelled iFood to +80% market share, can now only comprise 25% of iFoods restaurant portfolio at most — a steep cut — while other deals will need to be unwound in the next 6 months. (Bloomberg Linea)

Stat of the Week

Back to our tamer type of sexy: digital payments.

You already knew that Pix, Brazil’s instant digital payments system, is a global leader in its category. You knew it was so good that Colombia and Uruguay are even in talks to import it.

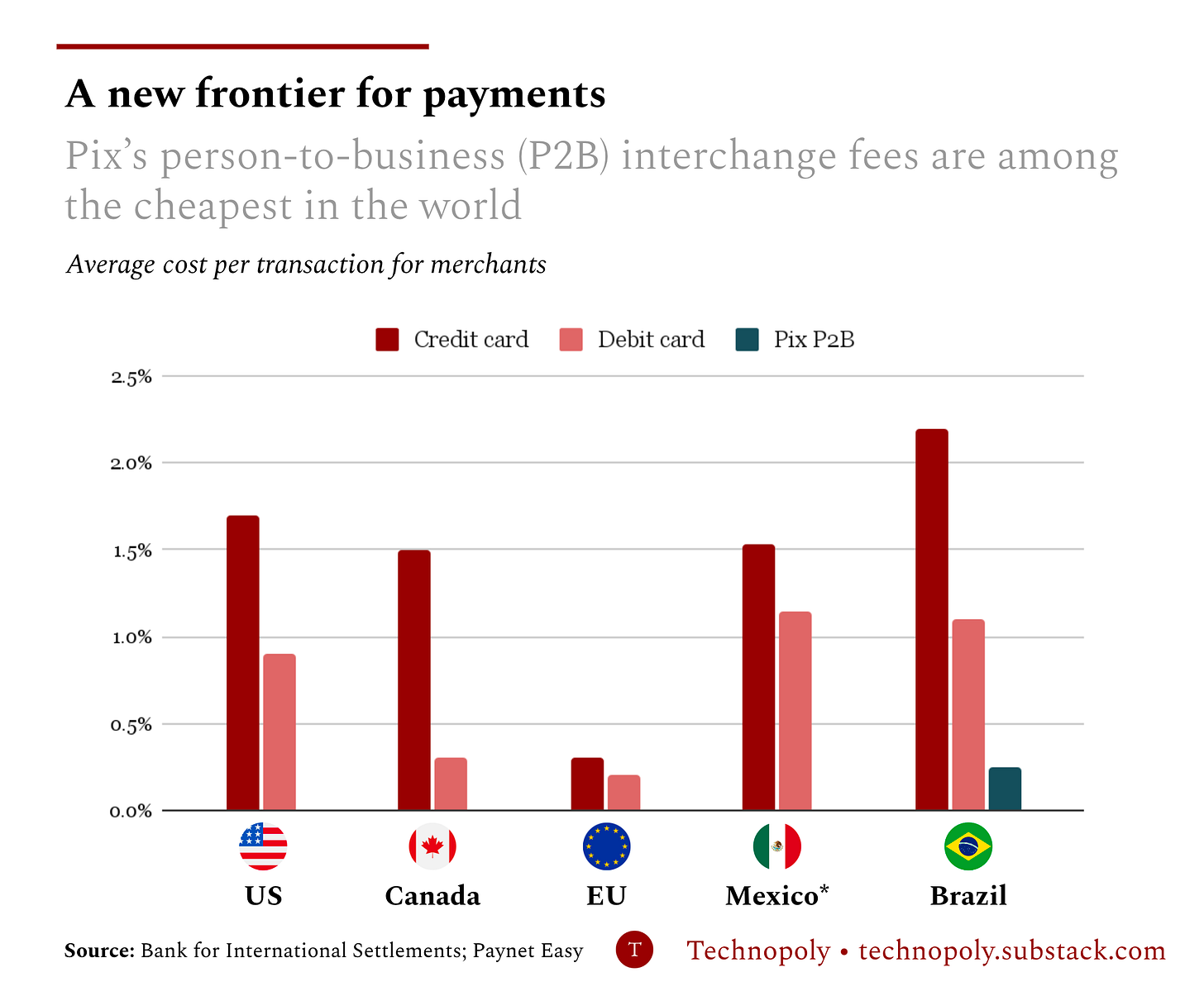

Data from the Bank for International Settlements shows just how, UX aside, Pix is a transformatively cost-efficient system for businesses as well as individuals.

So what? Want to induce a behaviour? Make it cheap.

High fees have historically been a key driver of low financial inclusion and digital payments adoption in LatAm. In response, lawmakers have tried boosting innovation through fee caps. Last year, Brazil capped prepaid card interchange fees at 0.8%, while Mexico did the same at 1.15%, in an attempt to spur new competition and redistribute those margins towards better user experiences.

Yet those are incremental changes. Pix (and those like it) is a paradigm shift. Pix’s fees are less than a quarter of the cost incurred by debit in the country — catapulting it ahead of Canada and the US, and towards a European level. P2B payments on Pix have already grown to nearly 20% of merchant transactions, and with fees this low, we’d expect merchants to continue moving towards it.

Smart Links

3 & 1/3 mega trends in Latin America (ALLVP)

Klar seeks to capture savings in 2023 and compete head-on with banks in Mexico (Bloomberg Linea)

After FTX, Argentina weighs up requiring solvency proof from crypto firms (Bloomberg Linea)

What Lula’s feud with the central bank means for crypto (Brazil Crypto Report)

Brazilian fashiontech Yuool goes international and considers physical stores (Startupi)

Meet Amela, a community for LatAm women founders to break paradigms (TechLA)

Yahoo closes operations in Brazil and lays off 80 people (Startups Brazil)

The apps changing how LatAm women access sexual health resources (Fast Company)

Deals (February 7-13 , 2023)

M&A

🇧🇷 PicPay, a consumer fintech platform, acquired 🇧🇷 BX Blue, a payroll lender for civil servants, retirees, and pensioners. Financial details were not disclosed.

🇧🇷 Inter&Co, the parent of fintech ‘superapp’ Inter, acquired 🇺🇸 YellowFi, a mortgage originator and fund manager. Financial details were not disclosed.

🇧🇷 Viveo, a medical devices manufacturing holding company, acquired 🇧🇷 Far.me, a startup that offers digital pharmacy services. Financial details were not disclosed.

🇧🇷 Pravaler, a student lending platform, acquired 🇧🇷 Workalove, an edtech platform for career guidance and development. Financial details were not disclosed.

🇧🇷 DB1 Group, a B2B software consultancy, acquired 🇧🇷 Smarppy, a software development agency for SMEs. Financial details were not disclosed.

Funding

🇦🇷 Michroma, a biotech for food colouring products, raised a $6.4mn seed led by Supply Change Capital with participation from SOSV’s IndieBio, GRIDX, Be8 Ventures, CJ CheilJedang, Fen Ventures, Boro Capital, The Mills Fabrica, Portfolia’s Food & AgTech Fund, New Luna Ventures, Siddhi Capital, Groundswell Ventures and Hack Capital.

🇧🇷 Amparo Saúde, a healthtech specialising in primary care, raised a $5mn Series B from Sabin Laboratory and angels.

🇨🇴 Blumer, a web3 social media platform that allows users to monetize their engagement through crypto payments, raised a $5mn seed from Inas & Tech.

🇦🇷 Polemix, a web3 “opinion” platform that allows users to support their favourite thought leaders, raised a $1mn investment from Globant’s Be Kind Tech Fund

🇨🇱 Auto.cl, a car data aggregator, raised a $1mn pre-seed led by Civic Inversiones.

Ad hoc

🇨🇭 responsAbility Investments, an impact investment fund, announced the close of its $101mn mezzanine financing fund to support sustainable food investments in LatAm.

🇲🇽 Arrendamás, a nonbank lender, received a $51mn financing package from the IFC. The funds will go towards SME lending in Mexico.

🇧🇷 IDB Lab, the Inter-American Development Bank's innovation lab, announced its investment in Monashees X, the Brazilian venture capital fund.

🇵🇪 BuenTrip Ventures, a Peruvian venture fund, announced an investment from IDB Lab. With the funding, BuenTrip will become the first institutional VC in Ecuador.

Did I miss any deals? Let me know!