#011: How is LatAm tackling financial inclusion?

VCs stock up on dry powder, and Nubank prepares for a shopping spree

Hey technopolists,

I’m back after a quick break! This week, stockpiling cash is the major trend across VCs and operators alike while portfolio values get slashed and layoffs just won’t lay off.

What’s hot

🏦 New money. Endeavor, the global accelerator and VC which has backed a rich set of Latin American startups, has closed its latest co-investment fund after raising a total of $292mn. The new fund is more than double the size of their last one ($130mn) and brings total assets under management to half a billion dollars. Endeavor now say they plan to double down on their LatAm investments. (Endeavor)

💰 Dry powder. Nubank has secured a $650mn credit line to go on an acquisition hunt during the economic correction, planning to focus the funds on buying small digital banks in Mexico and Colombia. CEO David Velez is preparing for LatAm’s fintech consolidation after an explosion of new entrants in 2021, stating that acquisition targets from last year are coming back to the negotiating table with as much as a 70% discount on previous prices. (Financial Times)

👭 Getting in (capital) formation. MAYA Capital, the Sao Paulo-based early-stage VC fund led by Lara Lemann and Monica Saggioro, has closed its second fund of $100mn. Saggioro and Lemann backed unicorns NotCo and Merama in their first fund, with a majority of their investment reaching female founders. The diversity is certainly needed: women make up 2.4% of general partners at venture firms worldwide, and in 2021, only 0.2% of venture funding went to all-women founding teams. (TechCrunch)

What’s not

📉 The layoff landslide continues. Clara, the Mexican fintech unicorn, confirmed it has laid off up to 10% of its staff this past week. The week prior, Brazilian unicorn Ebanx laid off 20% of its 1,700-person workforce, while Colombian unicorn Frubana let go of 3% of its staff. The three companies join a growing list of retrenched LatAm unicorns that includes Creditas, Loft, QuintoAndar, Facily, Vtex, Olist, 2TM, Kavak, and Bitso. The onslaught shows no sign of letting up, with several prominent VCs forecasting (and even promoting) their continuation. (Bloomberg Linea)

🔻 Sugar, we’re going down. Over two-thirds of VC funds around the world reported that their portfolios shrank during Q1 of this year, according to a recent analysis from Pitchbook. Affected funds reported an average markdown of 7.8%, amounting to $1.4tn in cumulative losses. While there aren’t hard numbers for LatAm yet, there’s obvious cause for concern: in 2021, 62% of VC investment here came from global funds, according to a recent report from Endeavor. (Bloomberg Linea)

Stat of the week

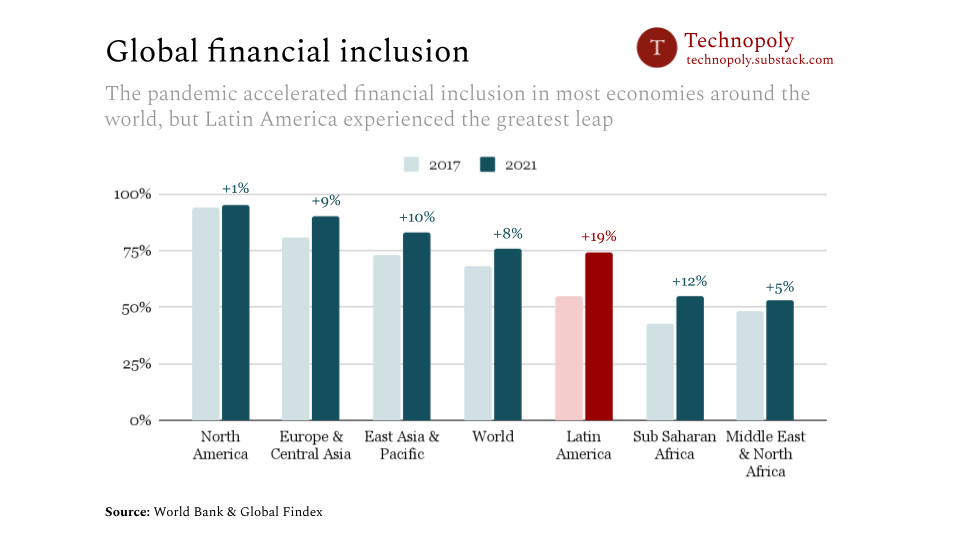

Getting people banked is a major catalyst for economic growth, making it a central goal for LatAm. Here’s a look at the World Bank’s latest data on inclusion.

LatAm is storming ahead.

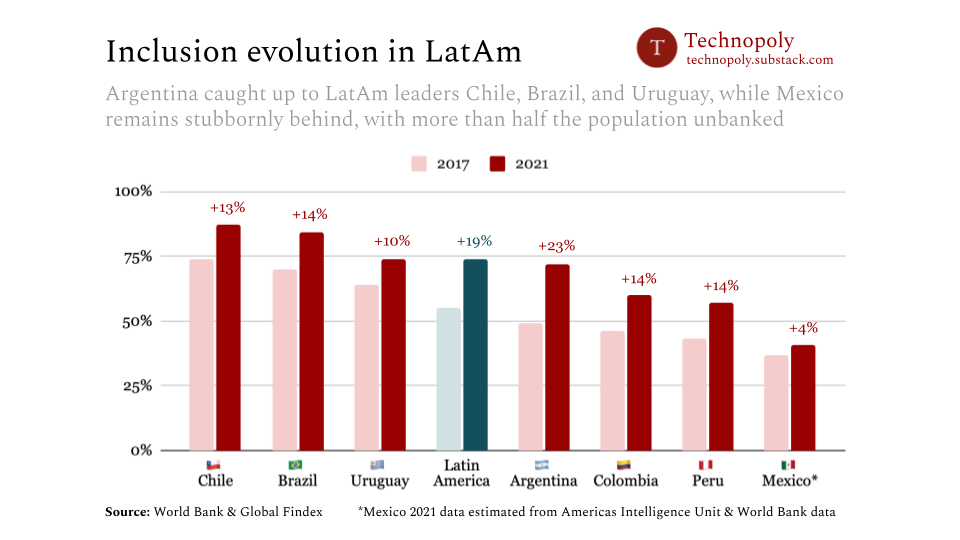

Who’s driving the change? Brazil, mostly, as the regional giant and fintech innovation hub — but a deeper look highlights that Argentina has made the greatest progress.

Why such high growth? First, covid. On average, 15% of adults in LatAm made their first utility payment from an account during covid – nearly twice the average rate in developing economies.

Then, politics and the macroeconomy. Central governments across the region have launched digital wallets to disburse incentives or pandemic stimulus to citizens to highly varying effect. Pix in Brazil has seen widespread adoption, but CoDi in Mexico and Chivo in El Salvador have done little to move the needle. Persistent inflation and foreign exchange issues in countries like Argentina have driven consumers to alternative digital assets like cryptocurrencies; many such users have opened up accounts as the first of their kind.

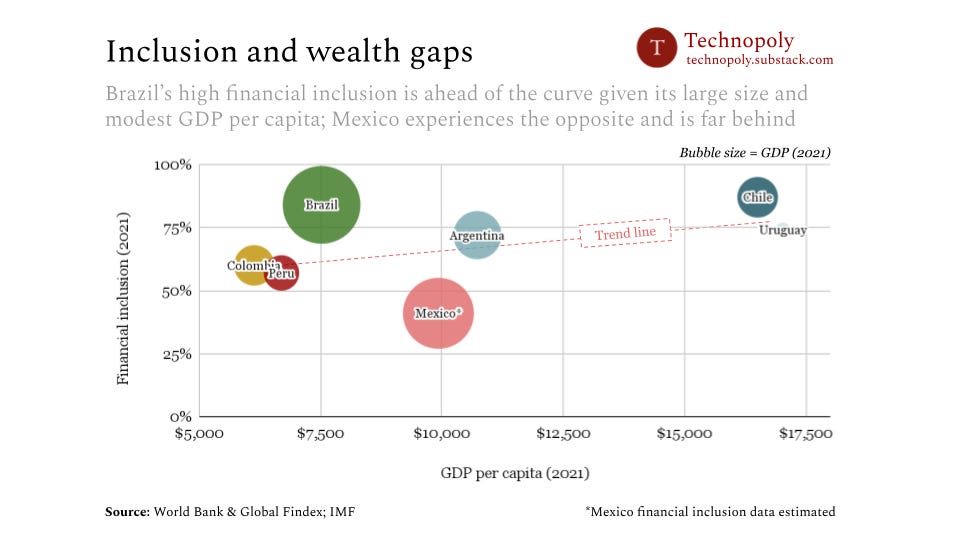

How do we know what “good” looks like? Inclusion rises as countries get richer and more productive, so we can see which countries are ahead or behind the trend:

Brazil’s growth is impressive: with 84% inclusion, they are ahead of Uruguay (74%) and only just behind Chile (87%), who both have nearly 2.5x Brazil’s GDP per capita. Conversely, Mexico’s lag is glaringly visible; fewer than 1 in 2 Mexican adults are banked despite being the 4th wealthiest country in GDP per capita, and inclusion has hardly shifted at all since 2017.

Smart links

Report: Venture Capital and Growth Equity Ecosystem in Latin America (Endeavor, Spanish)

Report: Latin American Venture Capital Compensation 2022 (Rising LatAm VCs)

Database: VC Funds investing in Mexico (Kate Kiewel)

Merama buys Latin American startups Miind Brands and Culotte (LatamList)

Why Latin America’s Startup Sphere Still Inspires Investor Optimism (Bloomberg Linea)

Mexican migrant town faces lure and lore of the American Dream (Reuters)

Downfall of Bolsonaro ally spotlights Brazilian leader's female voter issue (Reuters)

Ecuador deal reached to end weeks of deadly protests and strikes (The Guardian)

El Salvador to escalate its security crackdown after death of police officers (The Guardian)

Jubilation and hope as convention puts final stamp on Chile’s new draft constitution (The Guardian)

War on drugs prolonged Colombia’s decades-long civil war, landmark report finds (The Guardian)

Latin America lacks decent sex education in its schools (The Economist)

At least 100,000 people are missing in Mexico (The Economist)

Battle between Bolsonaro and a top Justice tests Brazil’s democracy (Bloomberg Linea)

The “Reserve rangers” of Venezuelan crypto currencies (Rest of World)

How football shirts chart the rise and fall of tech giants(Rest of World)