Nubank, Stone, Creditas, and dLocal: who’s keeping pace?

#068: Why tech has Argentina’s top presidential candidate in trouble.

Hola technopolists,

Earnings season is coming to a close with a flourish from late-stage fintechs Nubank, Creditas, and StoneCo. dLocal is trying to breathe life back into its valuation with a PR offensive – will it work?

Elsewhere, a crypto-fraud is dredging up skeletons in the closet of Argentine presidential candidate Javier Milei.

PS: Don’t miss out on the chance to get 50% off a paid subscription. Starting in September, only paid subscribers will get the full weekly edition plus a monthly deep dive and access to subscriber-only events. Free subscribers will only continue to receive What’s Hot/What’s Not — the rest will be paywalled. Offer ends midnight GMT, August 31st.

What’s Hot

🏦 Nubank’s huge Q2. The world’s largest neobank blew its Q2 forecast out of the water, with net profits of $225mn against consensus estimates of $147mn — a 53% overshoot. Revenue rose to $1.9bn, a stellar 61% increase from the prior year, as the bank approaches 85mn customers worldwide. Its credit portfolio remains equally healthy, with credit card loans growing 54% YoY as it prepares to launch a new payroll loan product. Zooming out: Nubank has doubled its customer base and 5x’d its revenue in the past two years. (Bloomberg Linea)

📊 Creditas’ path to profitability. The Brazilian lending unicorn continued its return to financial strength after a bludgeoning 2022. The credit portfolio is improving: gross profit grew to 28% from its trough of 12% last year, helped largely by stabilised interest rates. It’s also tightened its belt on operational costs, more than halving its net losses to -$24mn from -$58mn in Q2 last year, while slowing down its lending growth. (Startups Brasil)

🙋🏽♂️ dLocal’s surge. The Uruguay-based payments unicorn has nearly managed to regain the ground it lost after Muddy Waters’ shortselling report lopped 40% off its market cap last November. Q2 revenues rose 59% YoY to $161mn driven by strong payment volume growth, while its profit grew modestly despite some slight margin slippage. The results arrived days after Bloomberg reported potential sale rumours and coincided with the announcement that ex-Mercado Libre exec Pedro Arnt is joining as co-CEO, which sent stock prices surging 32% on the day. (Brazil Journal, Bloomberg Linea)

What’s Not

🟣 Nubank (share) price hiccups. Two events upset Nubank’s near-perfect run. Founder David Velez cashed out 3% of his shares in his first stock sale since the IPO for “general portfolio management reasons”, which sent shares tumbling 9%. Separately, when the neobank allowed more users to purchase Nucoin, its crypto-based loyalty token, excessive speculation shot prices up 2,000%, inspired fake Nucoin scams on rival platforms, and caused the platform to halt trading for a day. After trading resumed, prices plummeted to normal levels, but user complaints of lost Nucoin tokens continued throughout the week. (Brazil Crypto Report, Bloomberg Linea)

👮🏽 Crypto fraud and Milei. Argentine federal police have raided 23 locations related to defunct crypto company CoinX in an ongoing investigation into the company’s alleged operation of a pyramid scheme. The investigation was launched one year ago and coincided with a lawsuit against Javier Milei, Argentina’s frontrunning right-wing presidential candidate, who allegedly defrauded a segment of users after promoting the company and false promises of lucrative profits on social media. CoinX stopped paying its users back in March, and the outstanding case against Milei alleges ~$100k of damages. (Infobae)

Stat of the Week

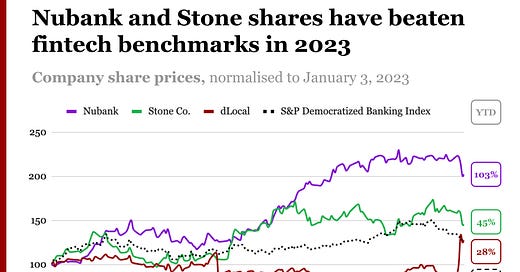

The onslaught of earnings announcements can feel like a flood of contextless headlines. With Q2 earnings behind us, we can zoom out to compare how major fintech stocks have rallied this year.

So what? Tech stocks have rallied in 2023 after a major reset in 2022, and fintech is no exception. In public markets, the sector is up 27% globally in 2023, and LatAm has followed suit — but not without its own wobbles.

Nubank: A blockbuster phase of growth – which saw it become Brazil’s fourth-largest bank – has earned a doubling in its share price. But CEO David Velez’s recent share sale was a blip that has (surprisingly) outweighed its sterling Q2 results.

Stone: The Brazilian payment stalwart had a price pop when it announced in April that net income increased 5.5x in Q1. Yet despite solid Q2 earnings, markets punished it with a 9% share slide because of a typo related to its EPS calculation. (linked below)

dLocal: The price drop in April came from Argentine authorities announcing a fraud probe following Muddy Waters’ November ‘22 shortseller report. Pedro Arnt’s star power coupled with solid Q2 earnings and potential sale rumours are trying to resuscitate what’s been an otherwise dour year. Arnt’s in, but the jury’s still out.

The Rundown

Interest rates on loans hit 790% in Latin America’s big fintech shakeout. (Bloomberg)

Latin American M&A dropped -34% in the first half of 2023, but analysts see appetite for growth in the second half. (Bloomberg Linea)

StoneCo reported solid Q2 earnings, but share price slid because of a poor results at Adyen and... a typo in its announcement. (Brazil Journal)

Revolut says Latin America is a key region for growth, focusing on Portuguese and Spanish expats. (Crowdfund Insider)

Brazilian healthcare brokerage Pipo Saude takes another step back, laying off 22% of its workforce after selling off its portfolio. (Startups Brasil)

Mercado Bitcoin laid off another 8% of staff in a new wave of consolidation. (Bloomberg Linea)

Forbes released the Next Billion-Dollar Startups List for 2023. (Forbes)

Deals (August 15-21, 2023)

M&A

🇧🇷 HealthAPI, an API-based platform for health data, was acquired by 🇺🇾 Axenya, a B2B healthcare platform, for an undisclosed amount. The deal was originally announced on August 10th.

🇧🇷 Cinnecta, an AI-based customer intelligence platform, was acquired by 🇧🇷 Matera, a banking software and instant payments company, for an undisclosed amount.

Fundraises

🇲🇽 Wonder Brands, an acquirer of ecommerce brands in LatAm, raised a $15.5mn Series A led by Nazca and IDB Invest with participation from CoVenture, SilverCircle, Korify Capital, Infinitas Capital, and GBM Mexico.

🇺🇾 BrainLogic AI, an ecommerce AI platform, raised a $5mn pre-seed led by Factory HQ. The company will use the funds to launch Zapia, an AI-based personal assistant available via WhatsApp.

🇧🇷 Munchies, a digital bank for decentralised finance, raised a $5mn seed from Canary and Latitud. The company has raised $7.5mn to date.

🇨🇴 Autolab, a platform for car services, raised a $4.1mn round led by Vertical Venture Partners and Haven Ventures with participation from Bullpen Capital, Polymath Ventures, Proeza Ventures, Interplay, and other undisclosed investors.

🇲🇽🇺🇸 Metabase Q, a cybersecurity platform, raised a $3mn Series A led by SYN Ventures with participation from GBM and John Watters.

🇲🇽 Maqui, a B2B supply chain management platform for the fashion industry, raised a $1.5mn seed led by Marathon Ventures with participation from Integra Group, NOA Capital, Nido Ventures, and Kupier Capital.

🇧🇷 Fintalk, an artificial voice intelligence platform, raised a $1.2mn seed led by Volt Partners.

🇧🇷 Voltta, a data intelligence platform for electric vehicles, raised a $900k strategic investment from Eneva, a power generation company.

🇧🇷 Fitinsur, an ‘insurtech-as-a-service’, raised an undisclosed amount of Series A funding from Lanx Capital and EquitasVC.

🇧🇷 Mitfokus, a fintech management platform for the health sector, raised an undisclosed amount from Bossanova Investimentos and angels.

Debt

🇧🇷 Meutudo, a fintech lender, raised a $400mn credit facility (FIDC) from BTG Pactual.

🇲🇽 Klar, the consumer financial platform, raised a $100mn credit facility from Victory Park Capital.

VC Funds

🇧🇷 SaaSholic, an early-stage fund focused on SaaS across LatAm, closed Fund II at $10mn.

🇧🇷 Verve Capital launched its second fund, targeting a $10mn close; it plans to invest the fund in 30 pre-seed and seed startups across Brazil and Latin America.

Simon Rodrigues is a consultant, writer, and speaker specialising in strategy and storytelling for early-stage startups.