Growing revenue, or cutting costs?

#048: A LatAm M&A wave crosses with a major fund announcement to reshape the downturn

Hola technopolists,

This week, the startup news cycle interrupted the glum routine that we’ve become so accustomed to reading. An avalanche of M&A brings consolation from consolidation, with fund managers and corporates still finding upside in the startup scene despite ever-mounting interest rates. No preamble needed.

What’s Hot

🤑 Mastercard and Visa are vying for a $1bn+ acquisition of Pismo, the Brazilian B2B fintech that enables financial institutions to launch consumer financial products like credit cards, digital wallets, and payments processing. According to reports from Pipeline Valor, Visa boosted its bid from $1bn to $1.4bn last week; in addition to the two card giants, a bank and private equity funds are also participating in the negotiations. The deal would be a solid payout for Pismo’s investors: a $1.4bn price tag double its value since its last fundraise, a $108mn Series B led by SoftBank, Accel, and Amazon in 2021. Across its many clients, Pismo boasts 74mn end users — a similar size to Nubank — with 30% growth in the last 6 months. (Seeking Alpha)

💰 Kaszek closed nearly $1bn in new funds across two investment vehicles: Kaszek Ventures VI, a $540mn early-stage fund, and Kaszek Ventures Opportunity III, a $435mn later-stage fund. Founded in 2011 by ex-Mercado Libre leadership, Kaszek is the region’s largest VC fund by AUM (now nearly $3bn) and is consistently one of the most active VCs, with notable investments in regional darlings such as Nubank, Creditas, Konfio, and Kavak. The two new funds are a mammoth achievement, increasing AUM by nearly 50% at a time when rising interest rates and cooling portfolio performances have led to a pullback. (TechCrunch)

🏦 Mexico’s Klar announced the acquisition of Sefia, a local collective savings institution, for an undisclosed amount. Sefia is a tiny institution with hardly 2,000 customers around Mexico, but as a regulated Sofipo, it now gives Klar a license to offer savings products. The deal exemplifies the same playbook previously used by Nu Mexico (bought Akala) and Fondeadora (bought Apoyo Múltiple): purchasing small licensed institutions to circumvent thorny regulatory approvals processes under Mexico’s oft-criticised Fintech Law. The acquisition is the latest move in Klar’s $90mn growth investment announced last June. (El Economista)

What’s Not

🔻 Creditas has been re-valued by its investors at up to a -60% decline from its previous valuation, according to reports from Pipeline Valor. Sources linked in Redpoint, one of Creditas’ early-stage investors, said the fund marked the company’s valuation down to $2bn from the $4.8bn it achieved last July. Pipeline also reports that Kaszek has marked down the fund containing Creditas shares by an average of -28%. The markdowns align with global averages of valuation reductions (40-60%) in late-stage ventures. CEO Sergio Furio’s response pointed to the company’s successful quarters of topline growth, skirting over a -$66mn decline in annual net income last year. (Pipeline Valor)

🛵 Rappi and Colombia’s Ministry of Labour exchanged fighting words as tensions rise surrounding proposed labour rights reforms for gig workers. In response to the proposed reforms — which include social security and pensions guarantees — Rappi CEO Simón Borrero claimed the average cost per delivery would rise $3.87, breaking the business model and threatening the country’s 80,000+ delivery workforce. Colombia’s Deputy Minister of Labour called Borrero’s remarks “a fundamental lie” part of the company’s “strategy of exaggeration” to smear the government. Leaked messages from Daniel Bilbao, co-founder of Truora and brother of Rappi co-founder Andres Bilbao, defended Rappi’s position, writing: “[if you think Rappi’s model is pure exploitation,] go tip every driver [$2.15] per delivery and you’ll be doing your part… To go against Rappi is to go against Colombian entrepreneurship”. (Bloomberg)

Stat of the Week

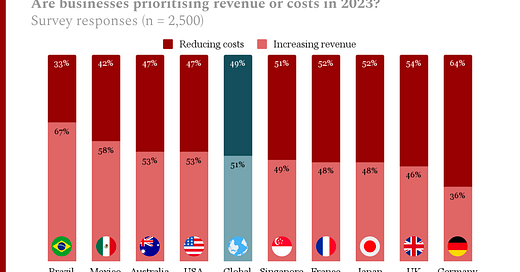

‘Growth at all costs’ isn’t boardroom advice you’re bound to hear much anymore; ‘unit economics’ is the new black.

If you only read the news, you’d be right to believe that profitability is the sole focus across LatAm now. But how much has this re-focusing actually played out across LatAm? Stripe surveyed thousands of businesses to find out.

So what? Despite the downturn, Latin American businesses are still prioritising growth over cost-cutting. In fact, they’re more growth-focused than the rest of the world. There are a few potential explanations as to why:

Market dynamics: Mature markets are more likely to be saturated, meaning that growth often requires taking market share from other players; as a result, growth can be costlier to pursue, so profitability is a more attractive endeavour. Conversely, In developing markets there’s typically less existing competition. For example, Nubank is competing with cash as much as it’s competing with other banks.

Ecosystem size: Mature markets are more likely to have a greater proportion of large, late-stage players. Since late-stage companies are more likely to need a clear path to profitability to exit, cost-cutting is likely to be the dominant focus. Developing markets, with a higher proportion of early-stage startups, are typically looking for traction to prove their business models and value propositions.

The Rundown

📱TikTok is accelerating its expansion in LatAm, opening new offices in Bogotá and Buenos Aires as regional hubs for the Andes and ‘Southern Cone’; today, the company has one LatAm office in Mexico City →

🛍️ Online fashion retailer Amaro filed for ‘extrajudicial recovery’ — Brazil’s equivalent of Chapter 11 bankruptcy — with total debts outstanding nearing $50mn →

🏦 German neobank N26 began onboarding standard Brazilian customers from its waitlist nearly 4 years after launching operations in the country →

🏧 A new study estimates that there are over 1 billion bank accounts in Brazil across a population of 215 million, with the average number of accounts per person rising from 3.5 to 5.2 in the past two years →

🔗 Retail investors in Brazil could be able to invest in tokenised government debt by the end of 2023 using the blockchain-based digital real →

🇧🇷 The Brazilian securities exchange commission (CVM) gave SMU Investimentos authorisation to create a tokenised secondary market for startup equity raised via crowdfunding →

🚔 A handful of Mexicans claimed police offers are accepting bribes using card payment terminals like Mercado Pago →

🚗 Mexico’s $100bn auto parts industry is reinventing itself for the EV era as manufacturers transition production lines to greener components →

📊 Infographic: Davi Plata and Nequi top the list of Colombian fintechs with the most users →

Deals (March 28 - April 3, 2023)

M&A

🇺🇸 PSG Equity, a growth equity fund, acquired 🇪🇸 Unnax, an embedded finance platform serving Southern Europe and LatAm, from Prosegur and Bankinter. The deal values Unnax at $45mn.

🇧🇷 Semantix, an AI-based data platform, acquired 🇧🇷 ATSaúde, an intelligence platform for public pharmaceuticals data, for an undisclosed sum. It is Semantix’s third acquisition after its IPO via SPAC.

🇦🇷 Globant, the global software conglomerate, acquired 🇧🇷 Nèscara, a Salesforce-based IT consultancy, for an undisclosed amount.

🇺🇸 Nespon Solutions, a Salesforce-based IT consultancy, acquired 🇦🇷 Certa Consulting, a company with the same services, for an undisclosed amount.

🇵🇪 Credicorp, a holding company, acquired 🇵🇪 Joinnus, a ticket sales platform, for an undisclosed amount.

🇵🇷 Zenus Bank, a local bank, acquired 🇵🇷 FUEX Payments, an API-based global payments solution, for an undisclosed amount.

🇦🇪 SYS Labs, a decentralised app (dApp) and digital asset management company, acquired 🇧🇷 Luxy, a multichain NFT marketplace, for an undisclosed amount.

🇨🇳 BeyondSoft, an IT conglomerate, acquired 🇧🇷 4MSTech, a specialist Microsoft Cloud applications consultancy, for an undisclosed amount.

Fundraises

🇪🇸 Cabify, the Madrid-based mobility platform with a significant LatAm footprint, raised a $110mn round. The round is a mixture of equity and debt: the equity comes from Orilla Asset Management, AXIS, and other undisclosed investors; the debt includes a $44mn loan from the European Investment Bank.

🇦🇪 Qlub, a contactless payments platform, raised a $25mn round co-led by Cherry Ventures and Point Nine with participation from STV, Raed Ventures, Heartcore, Shorooq Partners, FinTech Collective, and angel investors. The company operates in São Paulo and will use the funds to expand deeper within Brazil.

🇺🇸 TraderPal, a retail investment trading platform targeting Latinos in the US, raised a $10mn round from a group of LatAm family offices through TEK INNOVATION.

🇲🇽 Pacto, a point-of-sale payment platform for restaurants and bars, raised a $4mn seed led by DILA Capital with participation from FEMSA Ventures, 500 Global, Polymath Ventures, and others.

🇦🇷 Mamotest, an AI-based telehealth platform for breast cancer detection, raised a $3.3mn pre-Series A from Johnson & Johnson Impact Ventures, Merck for Mothers, Sky High, and Sonen Capital.

🇧🇷 Comp, a compensation database for Latin American startups, raised a $2.7mn round led by Kaszek with participation from Canary, Norte, 1616 Ventures, and angels from Nubank, Creditas, General Atlantic, Gusto and others.

🇧🇷 Aravita, an AI-based platform that helps retailers manage fresh food inventory, raised a $2.3mn round from Qualcomm Ventures, 17Sigma (Pierpaolo Barbieri), Bridge, DGF Investimentos, Alexia Ventures, BigBets, and Norte Capital.

🇧🇷 AgriAcordo, a data-driven marketplace for wholesale agricultural supplies, raised a $1.6mn round from Venture Capital Xperiments, Primary Ventures, Pampa Star, and others.

🇧🇷 BakeryTech, an intelligence platform for bakeries, raised a $1mn round from DOMO Invest, CRIVO Venture, Harvard Angels, and other angels.

VC Funds

🇧🇷 Kaszek closed two funds at a total of $975mn: Kaszek Ventures VI, a $540mn early-stage fund, and Kaszek Ventures Opportunity III, a $435mn fund for later-stage investments.

🇧🇷 4Equity Media Ventures launched a media for equity fund, with a targeted close of $100mn.

Did I miss any deals? Let me know!

To enquire about consulting engagements, speaking opportunities, and collaborations, reply to this message or send an email to simon@saber.works.