Is Brazil losing its lead?

#044: The most active venture funds in LatAm. Plus: SoftBank returns, WhatsApp launches merchant payments, and Nubank doesn't know how to stop

Hola technopolists,

Ask any founder, operator, or investor about the differences between countries in Latin America and you’re guaranteed to hear a version of: “Brazil is X years ahead of everyone else.” Ask a Mexican, and perhaps X = 5; ask a Brazilian, and you might hear 7, or even 10 after a few caipirinhas.

The data bears this out. Brazil comprises one-third of the region’s population and GDP but receives over half of its venture funding in any given year. In the ever-important fintech sector, Brazil has captured an eye-popping 80% of funding since 2014. In 2022, 32% of LatAm venture investment came from Brazilian funds — nearly as much as came from U.S. funds. Bank account penetration in the country crested 79% last year, compared to 55% across the region.

But there are signs that the Canaries may be losing their lead. VC funding into Brazilian startups declined the fastest in 2022 (-52%), a sharper drop than the global average (-42%) and regional neighbours Colombia (-25%) and Mexico (-47%). Brazil only produced 2 of LatAm’s 7 unicorns in 2022 — an underrepresentation compared to past performance; Mexico, too, produced 2 unicorns.

The recent picture only gets worse. Brazilian startups raised $85mn last month, an 88% year-on-year drop and the worst February results since 2016. In the same month, over 30 Brazilian startups made mass layoffs, with hundreds leaving up-and-coming brands such as Solfacil, Neon, and C6 Bank.

And the outlook doesn’t get much better. JPMorgan’s analysts are bearish on Brazil’s macro outlook while Mexico continues showing strength:

“Mexico is the silver lining in Latin America as it remains on a strong footing, on the back of resilient external demand, domestic consumption, and the catching up in fixed investment. . . Brazil, which was one of the first economies to tighten policy, will also be among the first to see a recession.”

Brazil’s early success has undoubtedly created the largest and most sophisticated VC ecosystem in Latin America. Yet it’s precisely Brazil’s scale that makes it vulnerable. The bigger they are, the harder they fall.

What’s Hot

🇯🇵 SoftBank announced its return to LatAm’s investment landscape after a notable retreat in 2022. Alex Szapiro, head of Brazil, stated its plans to allocate 50% of its remaining funds in the next 12-18 months to companies in its existing portfolio to fund M&A. Having originally announced $8bn in its LatAm fund, its portfolio is currently worth $6.4bn. The new strategy was on display last week with the announcement that Rankmi, a Chilean HRtech, raised $48mn from Softbank’s LatAm fund - which it used to buy Mexican HRtech Osmos. (Bloomberg Linea)

💬 WhatsApp business payments got the green light in Brazil with the country’s central bank approving Meta’s plan to enable small- to medium-enterprises to receive card payments directly within the app. Users have been able to make peer-to-peer payments to other users since 2021, but the new approval enables merchant to receive payments and paves the way for native shopping experiences within WhatsApp. Meta has made Brazil a key B2B testing ground as it launched business messages amidst stalling advertisement revenues. (Reuters)

🏦 Nubank cracked the credit card leaderboard in Mexico, with new analysis from Moody’s showing the neobank is the 5th-largest credit card issuer in Mexico. As of December 2022, Nu Mexico had issued 3.2mn credit cards, just behind Santander (3.7mn), BanCoppel (4.5mn), BBVA (7.4mn), and Citibanamex (7.7mn). In the same week, Nu named ex-PayPal and Meta exec David Marcus to its board of directors, while Brazil CEO Cristina Junqueira liquidated a sliver ($3mn) of her equity in her first stock sale. (Bloomberg Linea)

What’s Not

🏠 Mighty Brazilian unicorns made deep layoffs. Loft, the proptech unicorn, announced its fourth round of layoffs, reducing its workforce by 15%—some 340 employees—and bringing total layoffs to 1,200 (~35%) since 2022. The cuts are part of the proptech’s plan to drive profit from its Brazilian core after selling its Mexican business (Nomah) to Casai last year and announcing plans to expand deeper into São Paulo and Rio Grande do Sul last week. iFood, the food delivery juggernaut, cut 7% of its workforce (355 employees) blaming the ‘reality of the global economic scenario’. In reality, the cuts might be tied to news that it lost the right to continue its lucrative exclusivity contract practices, with big-ticket restaurants such as McDonald’s and Outbacks no longer tied into deals. (Estadão)

📺 Cinépolis’s streaming service kicked the bucket as the Mexican cinema chain’s on-demand service, Cinépolis Klic, announced it will cease operations on May 31, 2023, saying that extreme competition killed the platform’s viability. Pricing was untenable, with film purchases costing users above-average rates while rivals Netflix and Disney+ offered free tiers and slashed pricing. Disney+ delivered a coup de grace by deciding to pull its titles from Klic when launching their own streaming services. At its peak in 2020, Klic once boasted 4mn users across Spanish-Speaking LatAm but failed to ever reach the streaming leaderboards. (El Universal)

Stat of the Week

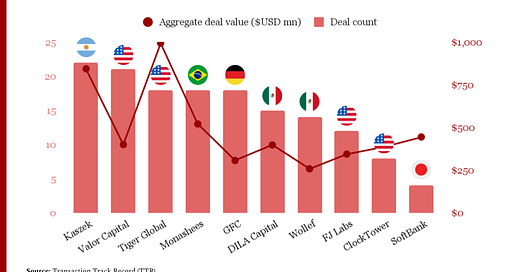

Back to our earlier question: is Brazil losing its lead? We’ve seen the answer amongst startups, but what about VC funds themselves?

So what? SoftBank’s monumental retreat created space for a reshuffling amongst local funds, while Americans have largely moved up the table by holding down the fort. Amongst the local funds, Mexico gained ground.

🇯🇵 SoftBank virtually vanished (4 deals in 2022 v. 34 in 2021) as its top team was reshuffled and its global portfolio haemorrhaged value

🇺🇸 Tiger jumped from up several places while ClockTower entered the list for the first time; Valor (21 deals in 2022 v. 29 in 2021) and FJ Labs (12 in 2022 v. 16 in 2021) both scaled back investments slightly, in line with global trends, but maintained a Top 10 spot

🇦🇷 Kaszek and 🇧🇷 Monashees, both on the list of most active funds in the region, maintained strong investment activity into their home countries

🇲🇽 DILA and Wollef joined the list of Top 10 investors for the first time, with DILA recently closing its fourth fund at $115mn

The Rundown

I’m running a test to upgrade Smart Links to The Rundown, giving you more context than hyperlink headlines alone in the same pithy format you’ve come to expect. Like, comment, or DM if you have feedback – good or bad – on whether this should stick.

Tesla announced plans to build an electric car plant in the Mexican city Monterrey, adding fuel to the country’s nearshoring ambitions and 2023 growth prospects. (Financial Times)

Digital nomads contributed $523mn to Mexico City’s economy in 2021—15% of tourism inflows—as controversy mounts regarding gentrification and Mayor Claudia Sheinbaum’s nomad-friendly policies. (Bloomberg Linea)

nstech, a logistics provider, announced a $300mn investment to launch Open Logistics, a new platform to integrate operational, financial, and risk management logistics solutions. (Startupi)

Tribal Credit abruptly closed operations in Brazil only a year after landing in the country, as the US-based business credit card provider blocked user accounts without any prior notice. (Startups Brasil)

Brazil’s Central Bank chose Hyperledger Basu for its pilot of the digital real that launches in May. (BlockNews)

Corporate Venture Capital (CVC) continues to grow in Brazil, with $582mn invested in 2022. (Fintechs Brasil)

Endeavor announced the 59 companies part of its 2023 Scale-Up Endeavor programme, with strong representation in fintech and B2B SaaS. (Endeavor)

Brazil’s development bank announced it will double its lending capacity to $20bn to attract new investment into critical projects in infrastructure and innovation. (Bloomberg Linea)

Investors are signalling a preference to hold cash in 2023, with 65% of investors surveyed by Bloomberg stating that keeping dry powder will be net-positive for their portfolios this year. (Bloomberg)

Deals (February 28 - March 6, 2023)

M&A

🇧🇷 Nuvini, a B2B SaaS holding company, went public via SPAC on the NASDAQ by merging with Mercato Partners. The deal values Nuvini at $312mn.

🇨🇱 Rankmi, an HRtech, raised a $48mn Series A from SoftBank’s Latin America Fund and used part of the round to acquire 🇲🇽 Osmos, another HRtech. Rankmi will use the funds and merger to grow its presence in Mexico.

🇪🇸 Rockin., a digital growth consultancy for startups, acquired 🇲🇽 nPotencia, a sales and marketing consultancy, for an undisclosed amount.

🇧🇷 Flash, a corporate benefits platform, acquired 🇧🇷 FolhaCerta, an HR automation platform, for an undisclosed amount.

🇧🇷 Gupy, a multi-service HRtech platform, acquired 🇧🇷 Pulses, an employee management and cultural engagement software, for an undisclosed amount.

🇧🇷 Arquivei, a tax document management software, acquired 🇧🇷 ConectaNF-e, a document upload automation tool, for an undisclosed amount.

Fundraises

🇪🇸 Voicemod, an AI-based voice enhancement software, raised a $14.5mn seed from K Fund. While their business is based in Spain, a significant portion of their customers are in Brazil.

🇧🇷 aMORA, a rent-to-buy real estate marketplace, raised a $7.7mn seed extension. The majority of the round is debt (a Real Estate Credit Receivables Certificate) from Cy Capital of Grupo Cyrela that will be used to purchase properties. The remainder is equity raised from Goodwater and existing investors.

🇧🇷 ContaFuturo, a credit card debt and overdraft servicer, raised a $3.9mn round from Empírica Investimentos.

🇧🇷 Barte, a B2B payments provider, raised a $3.1mn seed led by Force Over Mass.

Debt

🇲🇽 Konfio, a fintech lender, raised $225mn in two credit facilities from Goldman Sachs and Gramercy. This is the second credit facility the unicorn has raised from GS.

🇺🇸 Marco Financial, a Miami-based export financier with a heavy focus on Latin America, raised a $200mn credit line from MidCap Financial Investment Corp and Castlelake LP. Arcadia Funds also led an $8mn equity injection as part of the round.

🇨🇴 Avista, a fintech serving low-income earners and third-age pensioners, raised a $22.5mn credit facility from Accial Capital.

🇲🇽 Mattilda, a SaaS fintech/edtech platform for schools, raised a $10mn credit line from Addem Capital.

🇧🇷 Blipay, a payday lender, raised a $6.7mn credit receivables investment fund from SRM Ventures.

VC Funds

🇺🇸 Eduardo Saverin, Brazilian co-founder of Facebook, established an office in Miami for B Capital, his $6.3bn venture fund, and is looking to invest more deeply in LatAm.

🌎 Antler, the global accelerator and venture investment fund, announced plans to deploy $50mn in the country in the next 5 years and grow its portfolio from 6 to 100 companies.

Did I miss any deals? Let me know!