Who’s winning in the open finance goldrush?

#060: Stripe rides the nearshoring wave, Shein’s opening salvo on Mercado Libre, and Rappi’s credit boo-boo.

Olá technopolists,

The so-called ‘Long LatAm’ thesis is built on the assumption that long-term regional growth is virtually inevitable as the pie gets bigger for tech businesses. That’s certainly justified — especially in light of stubbornly low stats around low financial inclusion and internet connectivity — but it doesn’t dull the sharp edge of competition.

Titans are slugging it out this week: Stripe moved in on EBANX and dLocal, Shein took the game to Mercado Libre and Amazon, and Santander declared an offensive on Nubank.

What’s Hot

🌐 Stripe rides the nearshoring wave. The global fintech behemoth announced it will develop a new operations centre in Mexico over the next 3 years. The centre will become a 100-person regional service hub made up of cybersecurity and customer service teams. Stripe — which has been relatively quiet about growth figures in Mexico since its launch in past years — says it’s still betting big on low-cost skilled labour and the country’s digital growth potential. (Iupana)

🛍️ Shein opened its Mexican marketplace for new products and external sellers. The retail marketplace — which began a pilot in January—will now enable local third parties to sell through their platform, similar to Amazon and Mercado Libre. The move comes at the same time as news of Shein’s new warehousing in Mexico, and also broadens the platform’s product offering beyond clothes alone and into household appliances, electronics, beauty, and personal care. (El Financiero)

💳 Santander takes on neobanks in Mexico with a digital-first ‘credit card offensive’. The Spanish banking giant is pushing an online-only, streamlined onboarding process for its customisable LikeU physical card and Samsung-powered virtual card. As of March, Santander had 4 million credit cards in circulation, compared to Nubank’s 3 million, Stori’s 2 million, and Klar’s 1 million. (Iupana)

What’s Not

❌ Rappi cancelled customer credit cards in Brazil without warning. Affected RappiCard Visa Gold customers complained on social media that Rappibank blocked and terminated their agreements without any prior notification — even for customers who had paid their balances in full. In response, Rappi stated that it is pausing new lending while it reviews its credit in light of market changes — a potential signal that it’s worried about portfolio distress. (Valor Econômico)

💼 Brazil turns up the heat on Binance. The Brazilian Chamber of Deputies initiated a process to summon the crypto exchange to testify before Brazil’s parliament regarding alleged pyramid schemes facilitated by the platform. Binance — which currently faces a slate of legal probes around the world — is already under separate investigation by Brazilian federal authorities for allegedly assisting Brazilian users to evade the country’s crypto derivatives ban. In separate statements, Binance denied both claims. (Cointelegraph)

Stat of the Week

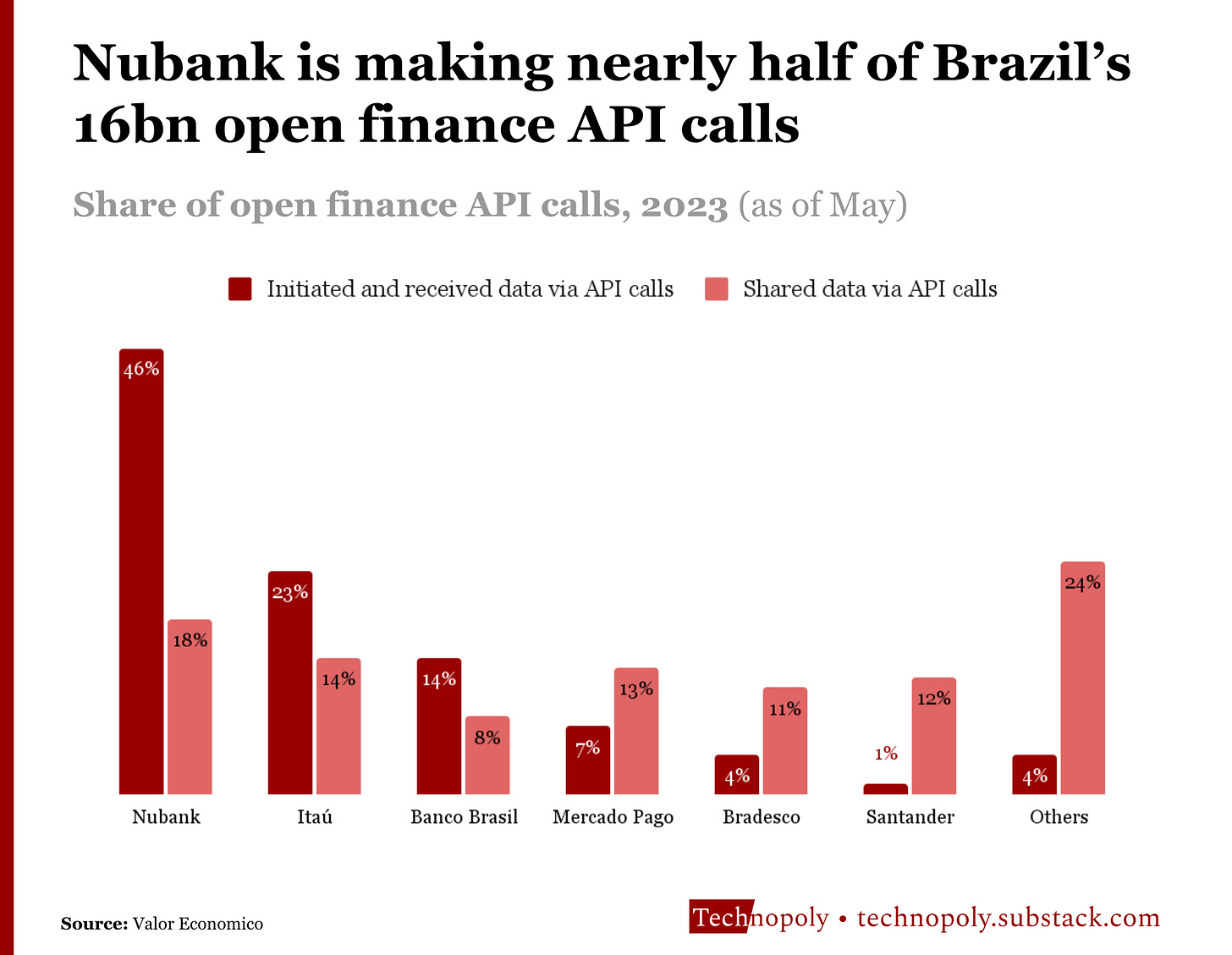

Open finance data is the lifeblood of fintech. From personal finance aggregation tools to credit lending algorithms, the data that open finance APIs provide are the building blocks powering faster customer journeys and more robust products.

In Brazil, who leads the pack in consumption and distribution of this renewable digital goldmine?

So what? Remember: to initiate an API call (dark red) is asking for data; sharing that data (light red) is merely responding to a data request. The relationship is like a researcher asking a librarian for a particular title.

Knowledge is power, and Nubank and Itaú are strengthening their digital might. Data alone doesn’t guarantee stronger results – but, in Nubank’s case, it’s an extraordinarily strong input indicator that helps understand how they’re achieving industry-beating delinquency rates on their Brazilian credit portfolio. Itaú and Banco Brasil – perhaps surprisingly, as legacy banks – show determination not to be subsumed by the neobanks.

Noticeably absent are neobanks C6 and Neon.

The Rundown

💯 Mercado Libre was rated as one of Time Magazine’s 100 Most Influential Companies. (El Economista)

🇲🇽 Mexico’s ‘super-peso’ reached its highest level against the dollar in seven years, but analyst say exports will likely suffer. (Reuters)

🌱 Despite its importance to global food supplies, Latin American startups only received 5% of agricultural VC dollars. (Neofeed)

🏷️ Tiger Global — which deployed $1bn into Latin America during the pandemic boom — is seeking bids to divest its portfolio in order to cover losses. (Pitchbook)

🇦🇷 PIX will soon be available for Brazilians to use in Argentina. (Melhores Destinos)

🇧🇷 Report: A market map of Brazil’s credit ecosystem. (a16z)

🔄 Brazil’s central bank expects to launch PIX Automático, a recurring payments feature, in April 2024. (Finsiders)

⚖️ After a 6 month grace period following its ratification, Brazil’s landmark crypto law officially took effect last week. (Brazil Crypto Report)

🇲🇽 Walmart is betting that Mexico will turn the digital corner with its payments investments. (The Brazilian Report)

🇸🇻 El Salvador upped the ante for its bitcoin bet: Volcano Energy announced $1bn in commitments to open a bitcoin mining operation. (CoinDesk)

📱 Spotify will launch a more expensive ‘supremium’ subscription tier for hi-fi audio and audiobooks, set for rollout in non-US markets later this year. (Hypebeast)

🇪🇸 How Latin American startups like Globant and Aivo are using Spain to scale up. (Bloomberg)

🏧 Mercado Pago now allows Chileans to withdraw cash from ATMs using contactless tech. (Tekios)

🏦 The World Bank approved a $700mn loan package to Mexico to boost women’s economic opportunities and physical security. (Reuters)

Deals (June 20-26, 2023)

M&A

🇧🇷 Open Co, a personal credit lender formed after the 2021 merger of Geru and Rebel, announced it will merge with 🇧🇷 BizCapital, an SME credit lender. Financial details were not disclosed.

🇨🇱 Airkeep, a luggage storage platform, was acquired by 🇬🇧 Stasher, a similar platform. Financial details were not disclosed.

Fundraises

🇧🇷 Asaas, a billing and payments platform, raised a $21mn Series B extension led by Inovabra Ventures with participation from Escala and Parallax Ventures.

🇪🇸 Fintonic, a digital lender and financial aggregator, raised a $20mn round through a mixture of equity and debt: $5mn in equity led by SquareOne Capital; and $15mn in debt from undisclosed investors. The company has a presence in Chile and Mexico.

🇲🇽 Clivi, a digital clinic specialising in diabetes, raised a $10mn seed led by Dalus Capital and Foundation Capital with participation from FEMSA Ventures and Quiet Capital.

🇲🇽 Glitzi, a beauty and wellness app, raised a $2.8mn seed from Goodwater, Y Combinator, Harvard Mgmt Seed capital, and others.

🇲🇽 SPAKIO, a storage and mini-warehousing platform, raised a $2mn round from Liverpool Ventures, Variv, and others.

🇲🇽 Scape, a platform for on-demand wellness and spa services, raised a $1.3mn round from 500Startups, Amplifica Capital, Angel Ventures, Daedalus Ventures, and others.

🇧🇷 Tarvos, a pest monitoring platform for agribusinesses, raised a $1mn round from Bossanova and Fundepar.

VC Funds

🇬🇧 Boost Capital Partners, an early-stage VC focusing on Europe and Latin America, launched in London this week. It claims to have secured $35mn of a target $40mn close for its inaugural fund.

Simon Rodrigues is a consultant, writer, and speaker specialising in strategy and storytelling for early-stage startups.