Silver linings for gender diversity (and fintech)

#055: Plus, Colombia’s Pix(ie) announcement and Shein’s down round.

Hola technopolists,

While we discuss the market correction as a monolithic megatrend, the pain is far from uniform.

Some are more precariously positioned than others. As an industry, e-commerce is down bad. This week, we see it in Shein’s down-round and Facily’s writeoff.

Demographically, non-Whites and women shouldered (and have been shouldering) deeply entrenched inequality. SoftBank is trying to make a dent into ethnicity, while we (and the IDB) examine the gender gap around Latin America. The results may surprise you.

What’s Hot

💳 Colombia announced plans to create its own Pix-like payment system. The National Development plan, rolled out by the country’s central bank in tandem with the national fintech association, lays the foundation for a low cost, peer-to-peer instant payments system. Last November, we covered how Colombia was in talks with Brazil to import Pix; so far, it hasn’t been decided whether the country will build its own system or license a version of Pix from Brazil. (Bloomberg)

💸 StoneCo, the Nasdaq-listed Brazilian fintech, beat analyst consensus and its own guidance by a large margin in its Q1 results. Revenue grew 31% YoY to $540mn, but the impressive story is profitability, which grew >5x to $48mn, largely driven by an increase in its payments take rate. Analysts see Stone’s future looking solid under new CEO Pedro Zinner, with the company expanding more into credit and bundled offerings. Share price bounced to its highest point since the beginning of 2022. (Brazil Journal)

🇯🇵 SoftBank launched its second Open Opportunity Fund (OOF) to raise and invest $150mn in US-based Black and Latino founders. The new fund follows on the success of its first OOF, a $100mn fund, and responds to gloomy data: in 2022, capital raised by Black founders dipped more than the industry benchmark, dropping to 1% of total capital raised. With OOF II, SoftBank will open up to new LPs and plans to deploy its capital in the next 3 years. (TechCrunch)

What’s Not

✍🏽 Brazil’s second most-active VC fund, Monashees, completely wrote off its investment in Facily, the Brazilian social commerce unicorn. The write-down follows a complete restructure, several rounds of mass layoffs, and 90% drop in GMV in the past year. At its peak, Facily achieved a $1.1bn valuation in 2021 and has raised $502mn from world-beating investors like Tiger Global, Founders Fund, and Prosus. Facily isn’t feeling the pain solo: social commerce startups have taken a beating in the correction, as evident when Colombia’s much-hyped Muni folded last November, less than 8 months after a headline $20mn fundraise. (Neofeed)

🛍️ Fast-fashion giant Shein raised $2bn in new funding but lowered its valuation by a third, according to sources close to the China-based fast-fashion platform. The round was co-led by Sequoia, General Atlantic, and Mubadala, and valued the company at $66bn. Shein was valued last year at $100bn — a market cap greater than Inditex (Zara, Massimo Dutti, Bershka, Pull&Bear) and H&M combined. The company recently announced a $150mn Brazilian manufacturing expansion that has attracted scrutiny and ire by local competitors after Marcelo Claure became LatAm chairperson. (Wall Street Journal)

Stat of the Week

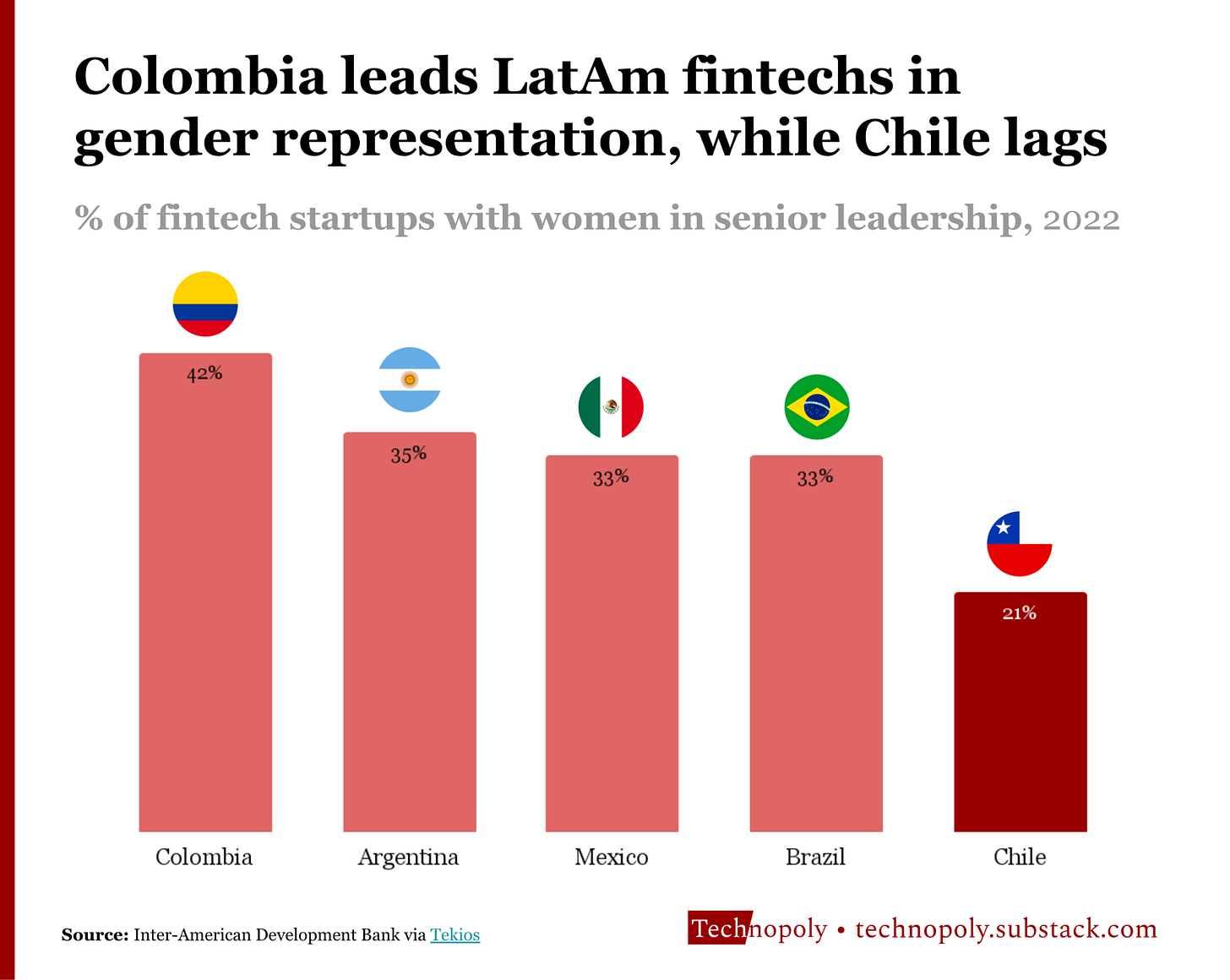

Gender equity has a deep challenge in the global tech world, and Latin America is no exception.

Latin American fintechs have made improvements in representation, but 12% of startups in the sector don’t have a single woman in their team, and only 15% have equal gender representation.

A recent study by the Inter-American Development Bank assessed the gender representation gap in the sector:

Colombia is a clear leader with Chile as the regional laggard – but how can we assess what’s surprising?

By comparing these figures to the World Economic Forum’s Gender Gap Index, we see that Chile’s lag is a fintech-specific issue – not a social one – while Brazil’s fintech scene actually outperforms what we’d expect based on broader social trends:

The Rundown

🏆 Pitchbook released its Global League Table of VC investors as of Q1 →

💰 The Mexican peso has climbed nearly 10% against the dollar this year, but analysts say its the rally’s days are numbered →

🇧🇷 Brazilian traditional banks have seen 57% drop in bank-to-bank payments volume in the last 5 years as fintechs grow →

🚗 Uber Mexico received authorisation to become an electronic payments institution (IFPE), the second mobility company to do so →

🏷️ Collapsing retail giant Americanas is entertaining bids for its fintech unit, AME Digital →

🍔 World-renowned influencer MrBeast launches burger chain in Mexico powered by Colombian foodtech Foodology →

🥑 Perfekto, the imperfect food marketplace, is going out of business after failing to raise new capital →

⛔ Uala shut down crypto payments in response to Argentina’s regulatory crackdown →

🌐 Chile’s Platanus Ventures announced the 17 startups in its sixth accelerator cohort →

🇨🇴 List: The Top 20 startups and most active VCs in Colombia →

🗣️ Interview: Hernan Kazah, co-founder of LatAm’s largest VC fund, talks about the future of VC in LatAm →

🪴 Analysis: How Latin America’s tech ecosystem is thriving on adversity →

Deals (May 16-22, 2023)

M&A

🇧🇷 TOTVS, a software and tech conglomerate, acquired 🇧🇷 Lexos, an omnichannel retail SaaS platform, for $2.7mn.

🇧🇷 WeON, an omnichannel communication and VOIP company, acquired 🇧🇷 DG Solutions, a telecoms service provider, for an undisclosed amount.

🇲🇽 Dahau Capital purchased a majority stake in 🇲🇽 National Soft, a POS provider for restaurants, for an undisclosed amount.

🇧🇷 Constanta Group, an IOT company, acquired 🇧🇷 Laager, a data management web platform, for an undisclosed amount.

🇺🇸 Mondee, a tech-driven travel marketplace, acquired 🇲🇽 Consolid, a B2B travel marketplace, for an undisclosed amount.

🇪🇸 Grupo Nexcom, a telecoms conglomerate, acquired 🇧🇷 Charisma BI, a data science and analytics company, for an undisclosed amount.

🇧🇷 Squadra, a digital transformation consultancy, announced the acquisition of 🇧🇷 Digicade, a georeferencing company, for an undisclosed amount.

Fundraises

🇧🇷 Track.co, a customer experience management (CXM) platform, raised a $6.7mn round led by Provence Partners with participation from TM3 Capital and Green Rock.

🇧🇷 Portal do Médico, a healthcare supplies marketplace, raised a $4mn round from SRM Ventures.

🇧🇷 Bluebell Index, a climate tech specialised in environmental asset offsets, raised a $2mn round from Minerva Capital.

🇺🇸 Eskuad, a Latino-founded mobile platform for field-data operations, raised a $1.7mn pre-seed led by Outlander VC with participation from Mis Inversiones, Behind Genius Ventures, C2 Ventures, Google for Startups, and angels.

🇧🇷 Silverguard, an anti-fraud startup, raised a $1.5mn pre-seed co-led by Astella and Latitud with participation from angels.

🇧🇷 Mob2Con, a data intelligence platform for retail, raised a $1mn round led by the Hindiana Investment Fund.

Funds

🇧🇷 The Brazilian National Fund for Scientific and Technological Development (FNDCT) announced a new $2bn investment vehicle.

🇯🇵 SoftBank launched its second Open Opportunity Fund to raise and invest $150mn in US-based Black and Latino founders.

🇺🇸 Manutara Ventures, an early-stage fund founded by Chileans, launched Fund II with a target $28mn close.

Simon Rodrigues is a consultant, writer, and speaker specialising in strategy and storytelling for early-stage startups.