LatAm breaks records with cash and media hits

#063: Superbac snags super-bags, titans join forces, and a neobank takes a hard look in the mirror.

Hola technopolists,

Latin America broke a few of its own tech records this week (two to be exact), and VC media is recognising it with a couple big boosts:

Latitud announced Ben Horowitz as a keynote speaker to its Vamos LatAm Summit.

Bicycle Capital’s Shu Nyatta and Marcelo Claure recorded an episode on Harry Stebbing’s cult-favorite podcast, 20VC.

What’s Hot

🧬 Big biotech. Superbac Biotech Solutions just raised the biggest ever biotech round in Latin America. The company, which isolates naturally occurring bacteria and replicates them for more sustainable agribusiness, bagged $62mn in a round led by private equity giants XP. This isn’t just a big win for biotech — it’s also a case of PE getting involved in venture to plug the growth equity funding gap. (Neofeed)

🤝 Nubank and EBANX link up. The two Brazil-born fintechs announced a partnership enabling EBAX’s merchants to accept NuPay for international checkout. Partnership announcements are usually blasé, but this one has decent reach: EBANX boasts 1,600 global merchants who can use the new system, and Nubank’s 75mn Brazilian users already have NuPay. A brief refresher: NuPay is a fusion of instant checkout, direct debit for recurring payments, and BNPL. (Fintechs Brasil)

🏦 Revolut ends the wait. It took 2 months for the UK-based neobank to onboard all customers from its Brazilian waitlist, but Revolut is now fully open for business in Brazil. It’s been a slow start for CEO Glauber Mota’s team, whose Brazilian launch was delayed at least 6 months, but the bank is open to the public and now holds a license to lend as a SCD. (Startups Brasil)

What’s Not

↪️ N26 retreats? The German neobank confirmed the dismissal of 15% of its Brazilian workforce last week. Normal, right? Except that Neofeed reported the bank had tried selling its Brazilian operations after a series of market entry mishaps – claims the bank denies. Analysts estimate that N26 has only 200,000 Brazilian customers after 2 years of operations, though Brazil CEO Eduardo Prota claimed that N26 Brazil has a waitlist of 800,000 users. (Neofeed)

🤦🏽♀️ Women’s fintech pay gap. New research from Fundação Getulio Vargas brings a series of sobering stats about Brazil’s financial workforce. Women work more and make less money: while 40% of the workforce is female, only 7% of leadership positions are held by women — and most are concentrated in support functions. Plus, women work 5% longer hours, on average. (Fintechs Brasil)

Stat of the Week

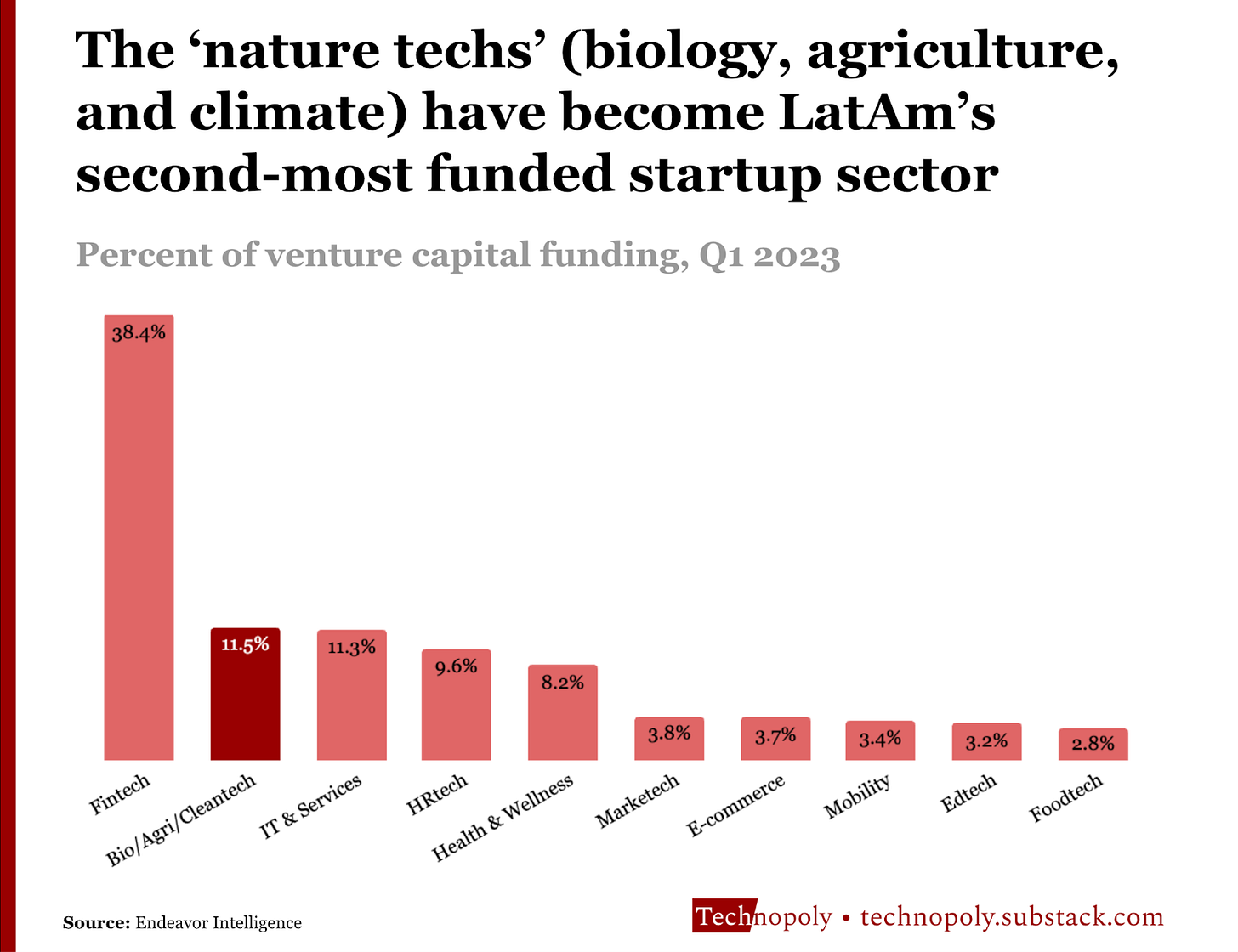

For Superbac’s $62mn round to be the biggest of its kind in biotech, surely the sector isn’t that big relative to other sectors – right?

So what? Biotech is big business. The trio of nature-techs (biotech, agtech, and cleantech) has been one of the more resilient sectors in the past year, with funding contracting by 50% while others declined over 75% on average. Let’s not forget that these are massive sectors, excluding their tech counterparts: Brazil feeds 10% of the world’s population, and some 60% of the world’s biodiversity calls Latin America home.

The Rundown

PIX processes 134mn transactions in a day, smashing its previous single-day record. (Startupi)

Ewally fires 4 senior execs and searches for a $12mn investment to turn itself around. (Fintechs Brasil)

JustForYou, the beautytech for personalised haircare, lays off 60-70 employees. (Startups Brasil)

iFood delivery riders are getting into physical fights over bike-shares in Brazil. (Rest of World)

“There’s never been a better moment for Rappi”: an interview with Rappi’s CEO of Brazil. (Startups Brasil)

Brazil’s central bank set off a crypto-Twitter revolt by announcing that code for the digital real will allow centralized back-door controls. (Brazil Crypto Report)

FDI into Latin American and the Caribbean surged 55% to reach an all-time high in 2022, according to UN report. (Reuters)

Deals (July 11-17, 2023)

Fundraises

🇧🇷 Superbac, a biotech developing bacteria-based fertilizers, raised a $62mn round from XP.

🇦🇷 InvGate, an IT operations SaaS platform, raised a $35mn round led by Riverwood Capital with participation from Endeavor Catalyst.

🇨🇴 Alegra, a cloud-based accounting platform for SMEs, raised a $22mn Series A from Riverwood, putting the company’s pre-money valuation at $76mn.

🇧🇷 Cobli, a freight and logistics software platform, raised $20mn round led by the IFC with participation from Fifth Wall, NXTP, Qualcomm Ventures, and GLP.

🇲🇽 Mattilda, a fintech SaaS platform for school administration, raised a $19mn Series A led by GGV with participation from FinTech Collective and DILA Capital.

🇵🇹 sheerMe, a beauty and wellness marketplace, raised a $2.5mn round led by Lince Capital with participation from Olisipo Way, M4, and others.

🇨🇱 Regcheq, a compliance SaaS platform, raised a $2mn round led by Taram Capital with participation from Grupo Sable and Consorcio.

🇪🇸 Hoop Carpool, a carpooling platform operating in Mexico and Colombia, raised a $1.3mn round led by Ship2B Ventures with participation from Banco Sabadell, FEI y Axis, 4Founders Capital, Lanai Partners, and angels.

Debt

🇧🇷 Culttivo, a fintech lender for coffee producers, raised a $15mn round through a FIAgro credit receivables fund (FIDC) from Octante Capital.

Funds

🇵🇪 Krealo (Credicorp Group) announced a $500k fintech fund to invest in 10 pre-seed startups across Colombia, Chile, and Peru.

Simon Rodrigues is a consultant, writer, and speaker specialising in strategy and storytelling for early-stage startups.