August’s top the VC ranks this year

#070: Mexico makes a second attempt with real-time payments.

Hola technopolists,

Last week, the case for optimism picked up steam with a series of strong earnings announcements.

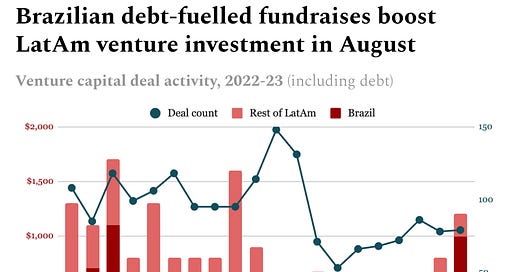

This week, a string of big investment announcements mean the figures are now there to back it up. August’s VC data shows that investors are willing to put their (debt) money where their optimistic mouths are, too (see more in the Stat of the Week graph).

Welcome to the first week of the paid tier. Upgrade to paid to gain access to the Stat of the Week, a rundown of recommended reads, and a list of all the disclosed deals in the past week. Plus, the first subscriber-only deep dive is dropping later this month — stay tuned.

What’s Hot

✈️ MELI’s Mexican moves. Mercado Libre announced a fresh $1.6bn investment package to expand its Mexican logistics infrastructure. The package focuses on expanding the Queretaro distribution centre, while including plans to add a new Boeing 737 to its existing three. The ecommerce-cum-fintech (cum-streaming) platform continues to double down on aggressive post-pandemic expansion in Mexico — accounting for 25% of its ecommerce revenue. (Tekios)

💸 DiMo direct transfers. Mexico’s central bank officially launched DiMo (short for “Dinero Móvil”), a new instant money transfer system designed to function solely with a user’s mobile number. The new system uses Mexico’s standard bank rails (SPEI) for 24/7 real-time payments, and users now no longer need their cumbersome 18-digit CLABE code to send money. With DiMo, Banxico hopes to improve financial inclusion and right the wrongs of CoDi, the failed P2P transfer system. I’ll be honest — DiMo is Hot because of its ambitions and novelty, but you’d be right to be skeptical that it’s probably more like FedNow than PIX. (Techla)

🤖 Intel in Costa Rica. The global semiconductor juggernaut announced it will invest $1.2bn in Costa Rica over the next 2 years to expand semiconductor production amidst rising global demand. Back in July, the US State Dept announced a partnership with Costa Rica as part of the 2022 CHIPS and Science Act, a Biden-era programme designed to strengthen American dominance in critical hardware. (Reuters)

What’s Not

✈️ 123Milhas bankruptcy. One of Brazil’s most popular online travel agencies filed for bankruptcy protection last Tuesday, seeking to stem the bleeding after it suspended the issuance of pre-purchased airline tickets and cut 7% of its workforce. The Belo Horizonte-based company racked up nearly $500mn in debt as it struggled to cope with inflation-driven cost increases and demand; over buying discounted packages it failed to sell as inflation hit. Its owners have ignored two federal summons to testify in front of parliament. (Bloomberg Linea)

🧠 Linda & Brazilian brain-drain? Early cancer detection startup Linda has fled Brazil and re-located to Canada in search of new pastures, sparking controversy about a Brazilian brain-drain in healthtech. Company execs claim they were denied by over 200 Brazilian investors before relocating to Toronto, where capital has come thick and fast — even attracting Brazilian investors after the relocation. Analysts have gone as far as saying Linda is an example of how Brazil ‘mistreats and wastes talent’ in the healthtech sector. (Neofeed)

Stat of the Week

VC’s headlines this year have been a stream of dour declarations: broad-based investment is 50-80% down in nearly any given months, and unicorns seem to have become mythical creatures once again.

But August’s venture data is in, and it might give you a rational basis to believe in fairy tales.