A turning point for startup funding?

#061: Visa (finally) buys Pismo in the first blockbuster exit of the year, while a chorus of investment leaders say the worst is nearly behind us.

Hola technopolists,

Well, we did it: the first major exit of the year.

Pismo’s $1bn is a far cry from past unicorn exits (Nubank and dLocal IPO’d at $41bn and £6bn valuations, respectively), but it’s more than enough to break the seal of M&A activity.

It seems like everyone is ready to call the bottom of the market, and ‘everyone’ includes Kaszek, the Nasdaq, broker giant XP, and LatAm VC Twitter.

What’s Hot

🤑 Visa buys Pismo for $1bn. The highly anticipated deal has finally closed in an all-cash transaction, marking a series of milestones: the biggest exit in LatAm this year, the largest fintech exit since Nubank’s IPO in late 2021, and the fifth largest startup deal worldwide in 2023. Pismo has landed big-ticket clients like Revolut, Itaú, and Nubank for its finance infrastructure platform, and Visa is betting that the deal will extends its reach into emerging payment rails. For the ecosystem, the deal brings a much-needed sense of optimism to M&A markets. (TechCrunch)

📊 VC funding bounces. June’s VC funding was the second highest month of the year, reaching $436mn across 84 rounds. While June’s figures are still a significant decline from the prior year, mega-rounds from La Haus ($62mn), Habi ($50mn), and Stori ($50mn) boosted investment 68% from May’s trough. Taken with Pismo’s acquisition, the Nasdaq logging its best first half of the year ever, and positive leading indicators from regional broker XP (more below), investor sentiment is slowly creeping back toward optimism for 2024. (Sling Hub)

💸 Mexico enables money transfers with just a phone number. The country’s central bank announced that DiMo (short for Dinero Móvil) will soon allow small businesses to receive payments with just a phone number, replacing the more cumbersome account number transfer system. The platform uses central transfer rails — a popular system that recorded 2.8bn transactions in 2022 — and is set for launch in the coming days, with BBVA already onboard and Santander following within the next week. It may not be Pix, but it seems to be better than CoDi. (Contxto)

What’s Not

👨🏽💻 Merama makes layoffs. LatAm’s ecommerce unicorn, which has cumulatively raised $345mn and was last valued at $1.2bn in 2021, announced 10% staff cuts as it makes a ‘strategic refocus’. The company says the shift is less about cost savings than doubling down on profitable business areas that work, but it’s another symptom of sector-wide malaise in ecommerce aggregators that’s seen the likes of Thrasio and Perch under pressure since last year. (Reuters)

🌐 The fight over Brazil’s Fake News bill reaches a new crescendo. The proposed regulation — which would put the onus on internet companies, search engines, and social media sites to filter fake news — was supposed to receive decisions on two Supreme Court appeals this week, which have been delayed indefinitely. To strengthen the counterpress against the bill, Google has officially appointed former president Michel Temer to lobby legislators. The bill has received so much private sector backlash that a high court ordered an investigation into execs at Telegram and Google for their alleged critical statements. (Reuters)

Stat of the Week

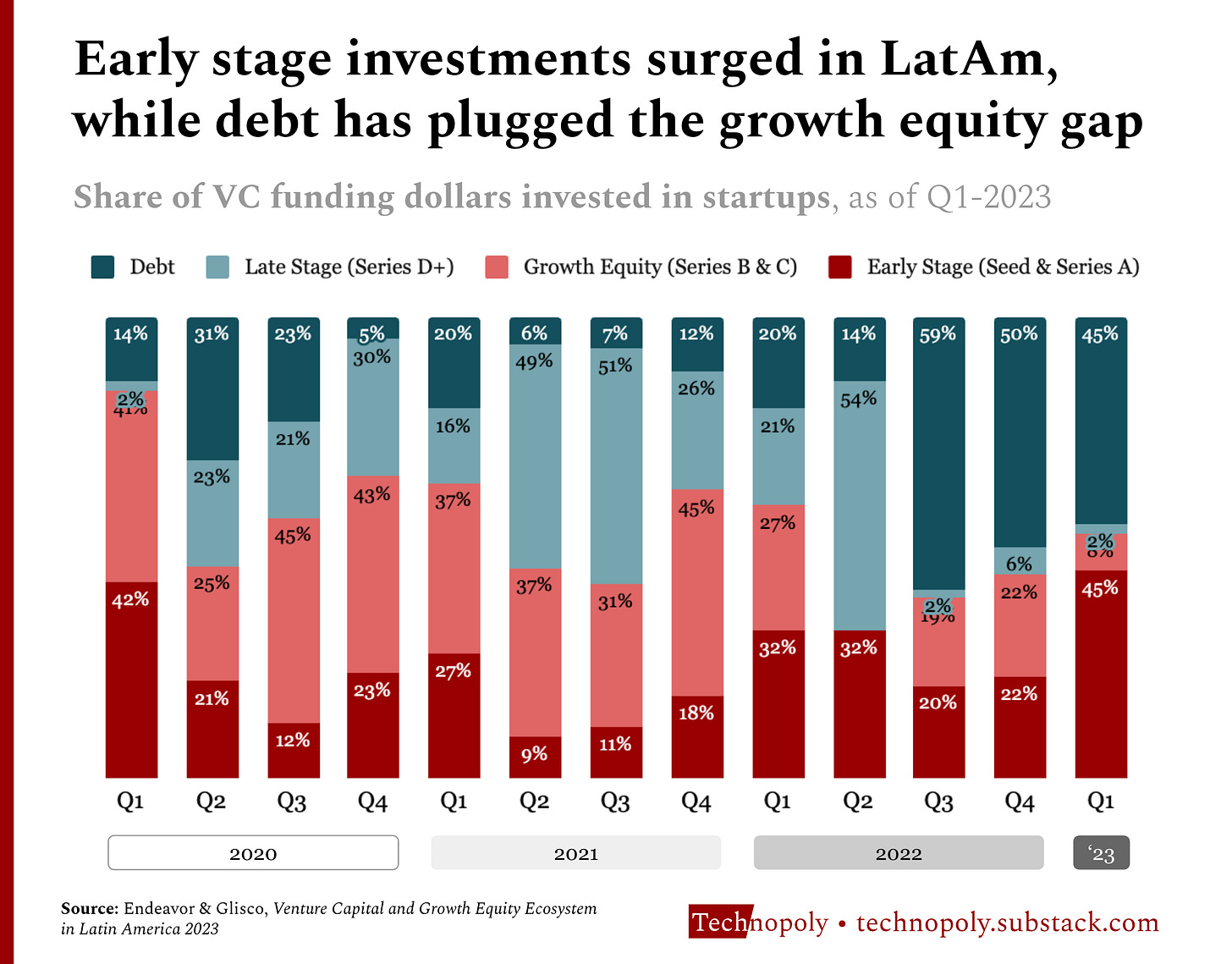

Endeavor and Glisco Partners release periodic report on the LatAm startup ecosystem, and each one is a goldmine of megatrend data.

I highly recommend digging into the 34-slide report — it’s full of digestible visuals, even for non-Spanish speakers — but for now, this chart does one of the best jobs summarising the evolution of the funding market.

So what? Three lightning takeaways:

Growth and late-stage equity has all but vanished. It began in Q3 last year with the flight of foreign capital (SoftBank, Tiger, Coatue, et al), and it’s not coming back until public markets perk up.

Debt has filled much of the gap — but is still quieter than last year. Debt is a mercurial beast: it’s been popular recently to help startups avoid dilution, but it’s also been popular in 2022’s boom, like when Kavak raised nearly $1bn.

Seed and Series A investments are carrying the region. The last time we saw early-stage investments this strong was in 2020. It’s tempting to conclude that this was a function of Covid-19 pandemic stress, but remember that Q1 was very early for markets to feel a significant impact on dealflow. Seasonally, Q1 is typically a relatively hot quarter for early-stage investments, too.

The Rundown

💰 Report: Cash usage fell 36% in Latin America as digital payment methods surge. (Kushki)

📊 Fintech brokerage XP Investimentos chief says that the worst of the contraction is behind us based on investment leading indicators. (FT)

🤔 Hernan Kazah of Kaszek: The VC pendulum swung from optimism to pessimism, but markets will return by 2024. (Bloomberg)

🌊 Mexico’s energy ministry announces it will meet its 2024 clean energy goals with new hydroelectric and solar plants. (Bloomberg)

🏭 Tesla’s new factory in Mexico divides local opinion in Monterrey. (Rest of World)

🌆 Brazil tops LatAm’s startup ecosystem ranking, while Mexico loses ground in StartupBlink’s 2023 ranking. (Contxto)

📶 Mexico approaches 80% its population with internet connectivity, with rural areas closing the gap to urban connectivity. (El Economista)

🛰️ Why did edtech Platzi put a satellite into orbit? (El Economista)

🤖 ALLVP reports that 46% of corporates in LatAm already use AI, and 93% plan to implement it soon. (Contxto)

🏦 Nubank: Bradesco and Santander reaffirm their ‘sell’ recommendation, saying its valuation is ‘difficult to explain’. (Brazil Journal)

💵 Brazilian neobank Neon is trying to disrupt a sector that others can’t. Will it work? (Neofeed)

Deals (June 26 - July 3, 2023)

M&A

🇨🇱 Fivana, an invoice factoring fintech, was acquired by 🇨🇱 Latam Trade Capital, a lender and trade financier. Financial details were not disclosed.

🇧🇷 SecuriCenter, a cybersecurity company, was acquired by 🇧🇷 Positivo, an IT and computing conglomerate. The deal is estimated to value SecuriCenter at $8mn.

Fundraises

🇲🇽 Nuvocargo, a cross-border freight management platform, raised a $36.5mn Series B led by QED with participation from NFX and Tiger Global. The round valued Nuvocargo at $250mn, up from the $180mn it achieved in 2021.

🇧🇷 VIPe, a personal finance and lending platform, raised a $22mn round from Airborne Ventures.

🇲🇽 Nexu, an auto loan comparison platform, raised a $20mn Series B from Spectra Investments and other undisclosed investors.

🇪🇸 Bdeo, a visual intelligence insurance platform, raised a $8.1mn round led by Íope Ventures (Wayra & Telefónica) with participation from K Fund, Hollard, Armilar, and CDTI. The company will use the funding to expand in Latin America.

🇵🇷 Raincoat, a finance provider for climate catastrophes, raised a $6.5mn round led by TwoSigma and Mundi Ventures with participation from Revolution and Ele Fund.

🇦🇷 Moova, an API platform for last-mile logistics applications, raised a $5mn round led by Toyota Tsusha with participation from Alaya Capital and Galicia Ventures.

🇧🇷 SuaQuadra, a commercial real estate marketplace, raised a $4.3mn seed led by Kaszek with participation from Canary, Caravela Capital, and ONEVC.

🇧🇷 Motrix, a school curriculum content platform, raised a $2.9mn round from Grupo Ágathos.

🇧🇷 Cargo Sapiens, a multimodal freight management software, raised a $1.5mn round from DGF Investimentos.

🇧🇷 Omni Saúde, a digital pharmaceuticals platform, raised a $1.3mn round from VEC Investments.

🇨🇱 GrupoTusMaquinas, a construction equipment marketplace, raised a $1.2mn round from undisclosed family offices.

Funds

🇧🇷 Pravaler, a combany backed by Itaú to finance education, raised $50mn for its Crédito Universitário I Fund from several investors.

🇸🇬 Circulate Capital, a VC fund focused on plastic reduction and the circular economy, announced its entrance into Latin America. The fund aims to invest $65mn in the region.

🇻🇬 Aquarius Capital, an early-stage fund, announced plans to invest $15mn in 25-35 startups, primarily in Colombia.

🇮🇳 Winzo, a mobile gaming company, announced $10mn of funding to invest in Latin American gaming companies.

🇧🇷 The Culture, Economy, and Creative Industry Ministry of São Paulo announced a $3.8mn investment into the state’s gaming industry.

🌎 Google announced a new $2mn fund to invest in gaming around Latin America.

Simon Rodrigues is a consultant, writer, and speaker specialising in strategy and storytelling for early-stage startups.