#037: What surprised us about 2022

Taking the long view to assess 2022 in Ventureville and quantifying the excess capital deployed during 2021’s bubble

Hola technopolists,

Not all that glitters is gold — but don’t say that to Miss El Salvador, who sported a gilded bitcoin-inspired bodysuit for the Miss Universe pageant in New Orleans. Just in time to align with her home nation’s new law paving the way for bitcoin bonds. Never a dull moment.

This week, I’m looking at the last 5 years of venture funding to gain some long-term perspective on 2022’s results.

What’s hot

📊 Nuvini prepares to IPO on the NASDAQ. The Brazilian company, which acquires and scales high-growth vertical SaaS businesses, launched in 2019 and recently began paperwork to merge with Mercato Partners’ SPAC. Deal details, including potential valuation and issuance size, have not been disclosed, though previous reports note that Nuvini briefly considered its local exchange before heading to NYC. Nuvini’s 4-year path to IPO is uncommonly quick for a tech company, especially given its relatively low profile. That’s explained by its business model: unlike many tech startups that are operating companies, Nuvini is really a holding company building its own portfolio, doing for software what Thrasio does for ecommerce. (Startups Brasil)

🏦 Santander prepares to bring its digital bank to Mexico. The Spanish bank announced the imminent launch of Openbank, its 100% digital bank sub-brand, in Mexico. Openbank currently serves 1.7mn customers in Europe (Spain, Germany, the Netherlands, Portugal) and Argentina with a suite of standard banking products from credit and debit cards to insurance and mortgages. Now, it’s taking aim at fintechs such as Nubank, Stori, Klar, and Fondeadora in a bid to compete for younger, digital-first users. Santander already provides some digital banking services to Mexican users (see: Como Tú credit cards), so we can deduce that they’re betting a fresh brand is the best way to build trust with customers and win share. (Forbes)

⛓️ El Salvador passes a law paving the way for ‘Volcano’ bonds. The new legislation sets out a legal framework for the issuance of bitcoin-backed bonds, which will be powered by Hong Kong-based Bitfinex. President Bukele originally announced plans to issue $1bn in bitcoin bonds in 2021 before political snags and a bitcoin price plummet induced delays. Funds will purportedly go towards paying down sovereign debts, mining bitcoin using thermal energy produced by Salvadoran volcanoes, and funding Bitcoin City, a utopian concept city. It’s unclear just how ‘hot’ this will turn out to be, as external institutions like the IMF condemn Bukele’s bitcoin policy and internal politicians claim the bonds will attract money laundering and fraud. (CoinDesk)

What’s not

🏠 Casai exits Brazil after a failed merger. The Mexico-based short-term apartment rental company is closing its Brazilian operations less than 6 months after its merger with Brazil-based Nomah. Loft sold Nomah to Casai in August 2022 and injected cash into the merged entity alongside blockbuster investors, from VCs (a16z, Monashees) to celebrities (Daddy Yankee, Ozuna, Albert Pujols). Their plan — to save a struggling business (Casai) by merging it with a healthy business (Nomah) — has flopped. Casai halted payments to certain landlords in Brazil at the end of 2022, though it says that all of its customers’ payments will be completed in January. (Bloomberg Linea)

🥑 Major food delivery companies make geographic retreats. Jokr, the NY-headquartered and LatAm-focused grocery delivery company, is closing operations in Colombia this month, only 2 months after leaving Chile and 6 months after leaving the US. In the same week, DiDi, the Chinese mobility company with a dominant position in LatAm, announced the closure of its Brazilian food delivery business, 99Food, alongside widespread regional layoffs. Both DiDi and Jokr stated the closures aim to bring the companies toward profitability in core markets — it’s just that the definition of ‘core’ continues to shrink. (Latam List & La Republica)

Stat of the week

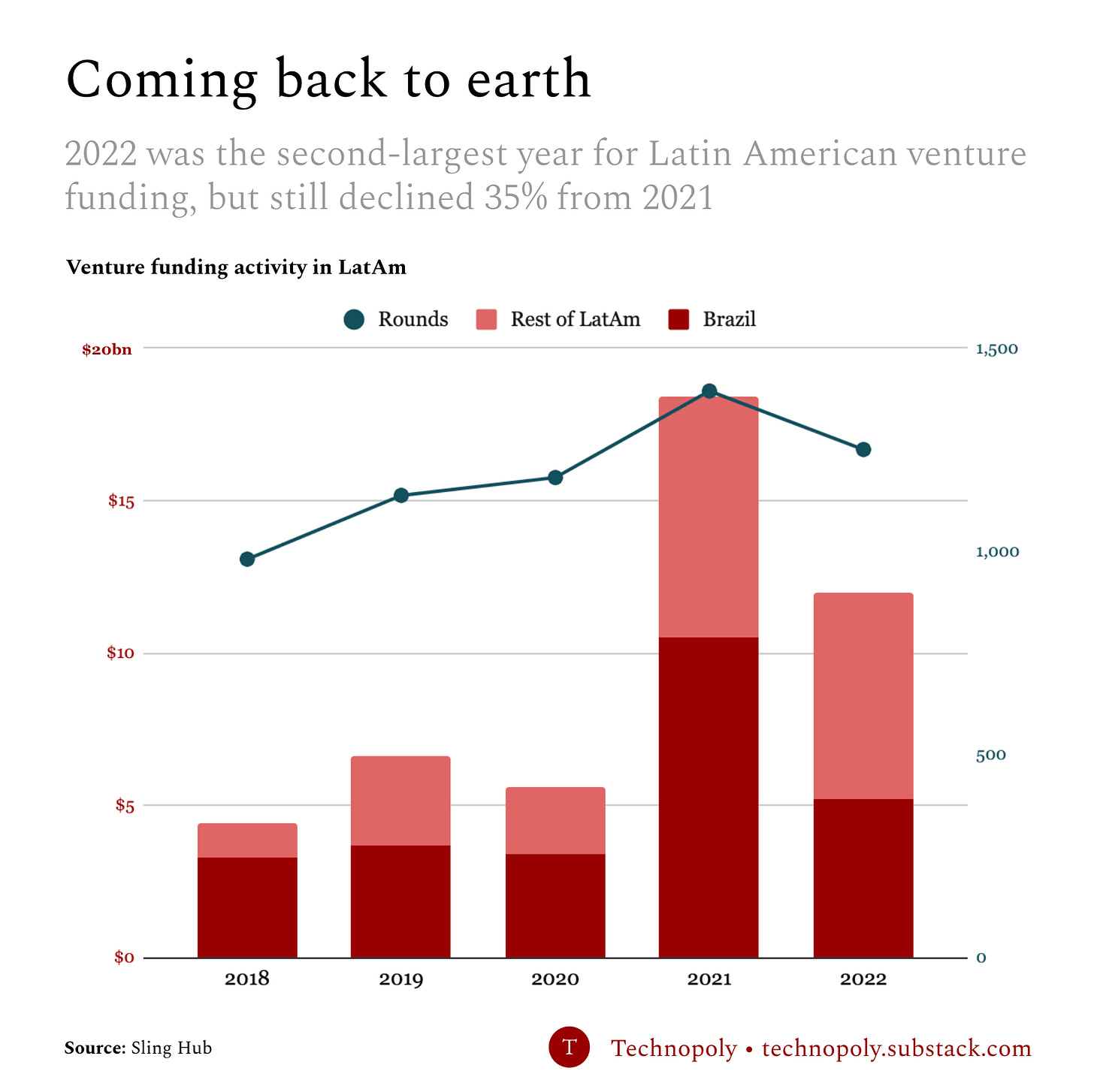

With full-year 2022 data rolling in thick and fast, we can take the long view of venture funding to crystallise some lessons from the last year. Here’s how VC funding stacks up for the last 5 in LatAm.

Note: I’m using Sling Hub data instead of often-quoted CB Insights. CBI’s data is great for a global view, but their LatAm data includes companies headquartered in tax havens like the Bahamas that don’t fit our conventional definition of Latin America.

So what? The optimists say that the turbulence of 2022 and 2023 will birth the strongest businesses of the next decade. The pessimists say that the boom-bust volatility of 2022 exposed the structural instability of growth-at-all-costs techno-utopianism. The realists say that 2022’s funding environment regressed toward a reasonable (and rapid) long-term growth rate.

They’re all correct.

These are the most interesting points from Sling Hub’s report:

2022 was a steep annual drop, but still the second-largest year for VC funding. Funding dropped -35% from $18.4bn (2021) to $12.0bn (2022). The average annualised growth since 2018 is 29%.

Round sizes dropped (with caveats). The average cheque size declined 27% from $13.2mn (2021) to $9.6mn (2022) — but that’s still nearly double the pre-pandemic average ($5mn).

Early stage is robust. The number of funding rounds for deals <$50mn increased from 2021 to 2022 by a slim margin.

Mega-rounds suffered. The number of funding rounds worth >$50mn declined year-on-year — the only segment to do so. Only 8 unicorns were minted, down from 18 in 2021.

The surprise: Brazil took a backseat. The lone lusophone nation comprised 43% of funding in 2022, the first time that it dropped below 50% of regional funding — a steep drop from the 73% it devoured in 2018.

Quantifying 2021’s bubble

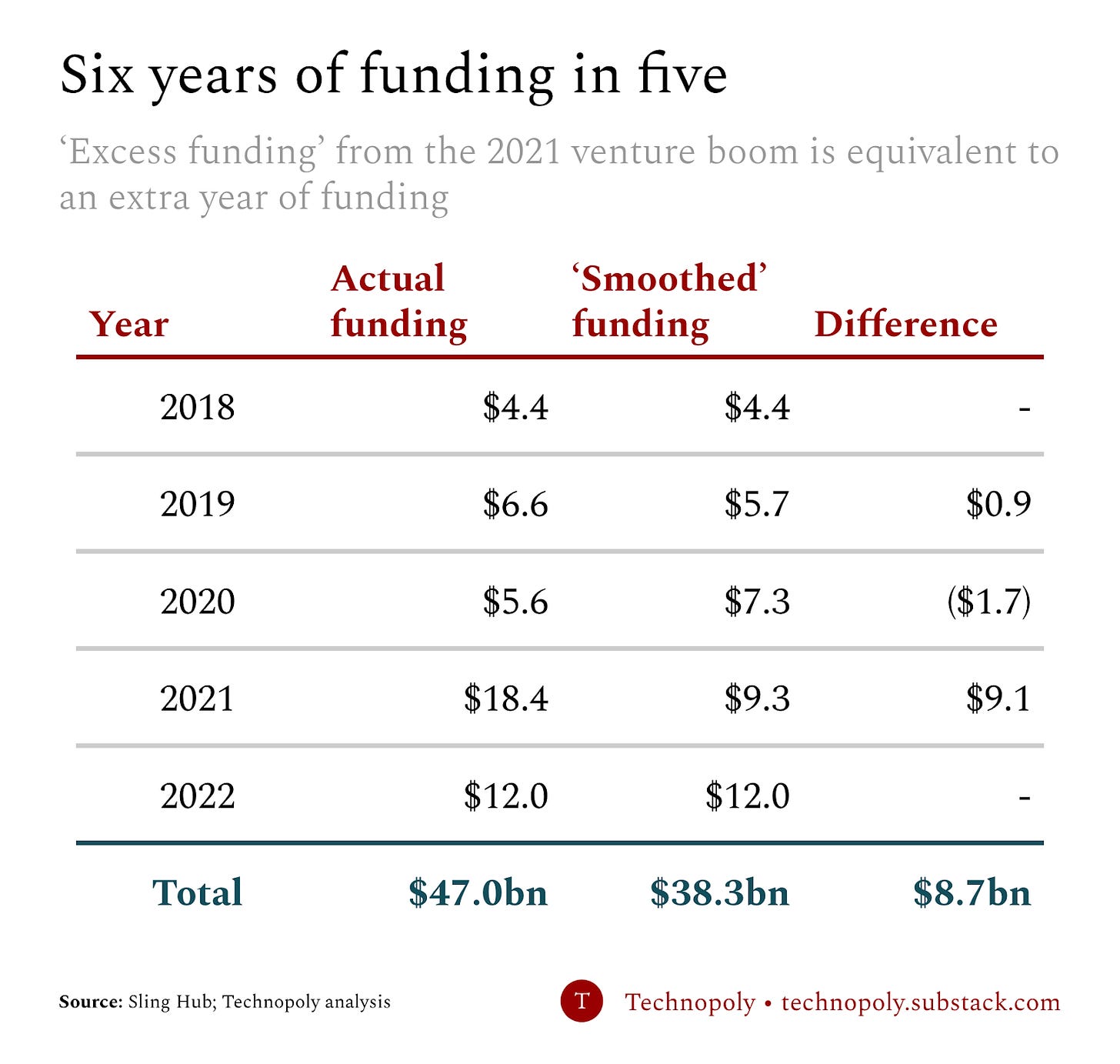

We can use the data to estimate exactly how much ‘excess capital’ was deployed in 2021 as a result of market exuberance.

Imagine there’s an alternative reality which looks similar to the real world, with one big difference: the 2020 pandemic slowdown and 2021 overheat didn’t happen. In this world, LatAm’s venture funding grew at a simple, smooth pace from 2018 to 2022 (29% per year, to be exact). Here’s how our actual experience compares to that alternative, ‘smoothed’ world:

The real world deployed $8.7bn more than the ‘smoothed’ world, largely thanks to 2021’s funding flood. In other words, the exuberance was equivalent to a full year of venture funding. It’s as though we squeezed 6 years of venture funding into 5 - not quite Kubitschek’s ‘fifty years in five’, but something like it.

Smart links

State of Venture Report 2022 (CB Insights)

Brazilian fintech Ebanx changes leadership, reinforces push to AI (Bloomberg Linea)

Payments firm dLocal to stick with cash, focus on growth (Bloomberg)

Law firm investigating FTX tokens also investigating dLocal (Newswire)

Chart: 9 of LatAm’s 10 biggest fundraises in 2022 happened in the first half of the year (Latinometrics)

Bradesco makes Brazil’s first regulated token transaction (Fintechs Brasil)

U.S. tech firms are replacing workers with cheaper talent in Latin America (Rest of World)

Americanas could face up to $8 billion early debt charges after accounting scandal (Reuters)

Deals (Jan 10 - Jan 16, 2023)

M&A

🇧🇷 Infracommerce, a retail technology company, bought 100% of the shares of 🇨🇱 Ecomsur Holding, an omnichannel sales company, for an undisclosed amount.

Fundraises

🇨🇱 BioElements, a sustainable packaging producer, raised a $30mn round led by BTG Pactual.

🇧🇷 Genial Care, a behavioural healthcare platform for children with autism, raised a $10mn round led by General Catalyst with participation from Atlantico, Canary, and angels.

🇧🇷 Descomplica, an edtech platform that helps students prepare for college entrance exames, raised a $6.4mn round from undisclosed investors.

🇲🇽 Universidad Uk, an online university, raised a $4mn round from Altum Capital.

🇦🇷 Celeri, a financial compliance software, raised a $2.6mn seed from Y Combinator, Funders Club VC, Commerce VC, Pioneer Fund and 22 VC.

🇨🇴 Rocketfy, a startup that enables businesses to create e-commerce platforms, raised a $2mn seed from Chile Ventures and angels.

🇧🇷 Transfeera, an open banking platform that enables automated payments, raised a $1.3mn seed led by 4UM and Honey Island Capital with participation from Bossanova Investimentos, Opus, Goodz Capital, and Curitiba Angels.

Ad hoc

🇨🇴 Habi, a real estate platform for buying and selling homes, raised a $6.3mn line of credit from Bancóldex.

Did I miss any deals? Let me know!