The biggest fintech opportunities in LatAm

#033: Fintech growth is strong, but very uneven. Some countries are lagging far behind in payments digitisation -- leaving ripe ground for growth.

Hola technopolists,

With crypto in a deep freeze, how should we feel about Messi being the marketing spokesperson for a crypto derivatives exchange? We’ll acknowledge it was produced pre-FTX collapse and file under ‘It Seemed Like a Good Idea At The Time’.

I’m working on something special for the end of the year, and while you wait, I suggest you watch Luis Chavez’s dazzling free kick for Mexico on repeat. Or, for something more nutritious, check out Latitud’s table-thumping 384-page magnum opus on the state of LatAm tech.

What’s hot

🏦 Brazil approves crypto regulation. The ‘Marco Crypto’, a landmark bill that lays out a regulatory framework for crypto in Brazil, was approved by the Brazilian Chamber of Deputies last week and is now awaiting presidential approval. The law includes the appointment of a crypto market regulator — which will almost certainly be the Brazilian Central bank, currently sandboxing a blockchain-based digital real — to oversee the sector. The appointed regulator will then have 6 months to create fresh licensing criteria that crypto companies will have 6 months to bring themselves into compliance with. The bill, which had an unexpectedly long gestation after being paused for Brazil’s high-stakes October elections, is a first of its kind globally. (Brazil Crypto Report)

🌐 Corporates flock to VC. Deloitte Ventures, the consulting firm’s venture-focused consulting arm, has launched in Brazil, becoming the latest corporate venture capital (CVC) convert to reach LatAm. Deloitte is part of a surge of large corporates that have ramped up VC activity through investment, M&A, and partnerships; new data shows that roughly half of large corporates in Brazil now have some form of CVC structure to invest in high-growth startups, with an additional 10% planning to launch one in the next year. (Startupi)

🙋🏽♀️ Brazilian women (fund)raise each other up. Feel, a Brazilian femtech specialising in sexual wellness, has become the LatAm startup with the highest number of female investors after its latest funding round. Despite its small size ($190k, pre-seed), the round was led by Sororitê, an all-female angel syndicate with an 80-woman strong investor network; in total, over 85% of Feel’s capital has been raised from women. According to research from Platzi, only 31% of venture capital raised in LatAm goes to companies with at least one woman in leadership; while the figure is still far below gender parity, it has shown significant progress by nearly doubling since 2019 (16%). (Latam List)

What’s not

✂️ Bitso makes large-scale layoffs, again. The Mexican crypto exchange cut 25% of its staff last Tuesday in response to the FTX-triggered ‘winter’ in cryptocurrencies. These cuts follow Bitso’s previous round of layoffs last May, when it cut 80 employees in response to the worsening tech market outlook. In case you’ve missed it, it’s been a rough month for crypto — and Bitso hasn’t been spared. After FTX’s November collapse set off a crisis of confidence across global crypto markets, the company faced mounting pressure from users to increase transparency around the availability of client funds and balance sheet exposure to FTX. Bitso is set to publish a solvency report in the coming weeks and is selecting an external partner to carry out a formal audit. But they’re certainly not the only recent casualty in the FTX fallout: Argentine Lemon Cash made 38% job cuts last week; NY-based BlockFi declared bankruptcy; Dubai-based Bybit announced 30% job cuts; and Australia-based Swyftx announced 35% job cuts. (Bloomberg Linea)

😒 dLocal is slipping. Carson Block’s infamous short selling firm, Muddy Waters, said last week it’s “more convinced than before” that the Uruguayan payment unicorn is up to no good: namely, fraud and misuse of client funds. In response to MW’s short position, dLocal has embarked on a charm offensive through a series of investor communiqués that amount to, in MW’s terms, “non-specific, non-substantive denials” of the fraud allegations. dLocal has stated there is no wrongdoing, though they have yet to issue a direct, written refutation of the short seller’s claims. dLocal shares slid 15% after Muddy Waters’s statement; overall, the company has shed nearly 40% of itsmarket cap since the short was originally announced. Separately, Block’s firm is one of dozens of short sellers and hedge funds under investigation by the Justice Department for suspected coordinated manipulative trading. (Reuters)

Stat of the week

dLocal having its Block knocked off shouldn’t distract us from LatAm’s durable payments revolution. We’ve met with Triumph (Pix) and Disaster (Chivo) — but we shouldn’t treat these two just the same.

How does the payments landscape differ across LatAm?

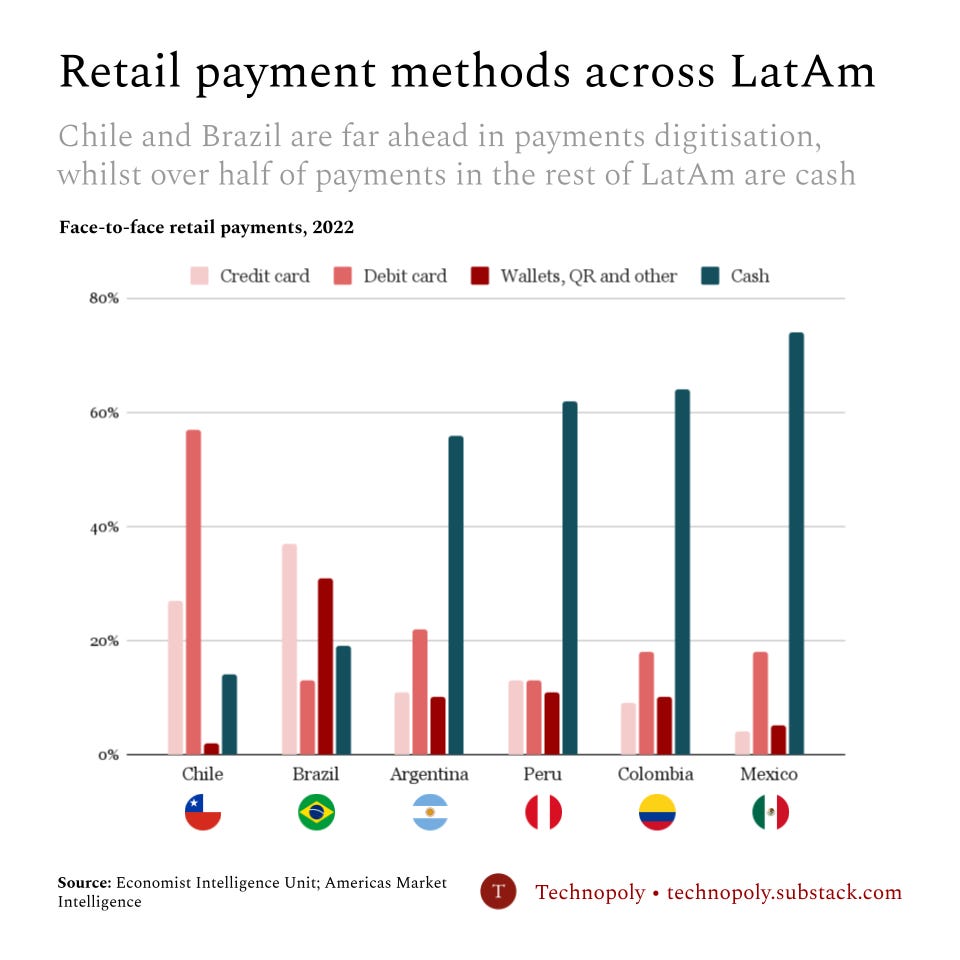

So what? Across LatAm, cash represents 46% of face-to-face retail payments, down from 75% before the pandemic in 2020. Digital and card payments are far advanced in Chile and Brazil, and Brazil especially stands out for its high prevalence of QR payments (largely down to Pix’s breakout success). Mexico stands out as a laggard, where cash payments stubbornly dominate 76% of F2F payments; what’s more, credit and QR codes stand out as heavily underpenetrated, even compared to Colombia. As LatAm’s second-largest geography, it’s no wonder that Mexico is a key fintech battleground for consumer fintechs such as Nubank and Stori.

Smart links

The LatAm Tech Report (Latitud)

Brazilian unicorn Loft denies down round (Bloomberg Linea)

Brazilian unicorn Wildlife slashes 20% of staff (Bloomberg Linea)

Private bid from General Atlantic & Dragoneer boosts Brazilian edtech Arco’s stock price (Bloomberg Linea)

David Vélez relinquished his stock options. Here’s what matters for Nubank (Brazil Journal)

Bitso, Plerk, Ualá, Wildlife, Lemon Cash and Kavak: Latam startups with recent layoffs (Contxto)

Deals (November 29 - December 5, 2022)

M&A

🇧🇷 WEG, an industrial electronics manufacturer, bought 🇧🇷 Mvisia, an AI-based industrial process control software, for an undisclosed amount

🇧🇷 Patria Investments, an alternative asset management fund, bought 🇧🇷 Igah Ventures, a venture capital fund, for an undisclosed amount

🇨🇱 FudLup, a restaurant supply chain software, bought 🇨🇱 Guía Horeca, a directory-like platform for hotels, restaurants, and cafés

Fundraising

🇧🇷 BR Media, an influencer-based marketing agency, raised a $20mn investment from Bridge One

🇨🇱 Destácame, an alternative credit scoring fintech, raised a $10mn Series B led by Banco Santander with participation from Kayyak Ventures and FEN Ventures

🇵🇪 Wynwood House, a short-term rental marketplace, raised a $7mn seed round (mixture of equity and debt) co-led by FEN Ventures and Innogent Venture Capital

🇨🇱 Kredito, a digital lending fintech for SMEs, raised a $6mn investment from Genesis Ventures, Amarena, and Grupo Penta; Kredito is also partnering with Grupo Penta

🇧🇷 Smart Break, a vending machine-like “micromarket” provider, raised a $6.9mn investment led by Headline with participation from UVC Investimentos

🇧🇷 Piwi, an employee insurance and benefits platform, raised a $4mn investment led by DNA Capital with participation from Scale-Up Ventures (an Endeavor Brasil fund)

🇨🇱 Toteat, an operations management software for restaurants, raised a $3.5mn investment from Morro Ventures and angels

🇨🇱 Betterplan Advisors, a wealth management advisory platform, raised a $2.3mn investment from undisclosed investors

🇨🇱 Racional, a retail investment platform, raised a $2mn round co-led by Genesis Ventures and Amarena

🇲🇽 BioEsol, a renewable energy provider for SMEs, raised a $1.5mn pre-seed from Techstars, Katapult, Innlite, and GVM

🇧🇷 Scaleup, an online learning platform, raised a $1.3mn angel round from BR Angels

🇧🇷 Cash.In, a payments platform, raised a $1.3mn investment from Bertha Capital

🇧🇷 100 Foods, a foodtech for plant-based products, raised a $750k seed round led by Futuram Capital with participation from angels

🇧🇷 Feel, an intimate products femtech, raised a $190k seed round from Sororité

🇲🇽 Metabase Q, a cybersecurity platform, raised an undisclosed seed round amount from undisclosed investors

Did I miss any deals? Let me know!